Financial Management

Category :

9. Financial Management

INTRODUCTION

A detailed account of financial management and financial decisions related to investment, financing and dividend. It states the meaning of financial planning, fixed capital and working capital under the capital structure.

Chapter at a Glance

MEANING OF BUSINESS FINANCE

Money required for carrying out business activities is called business finance.

Business finance is required for the following activities:

1. It is needed to establish a business, to run it, to modernise it, to expand, or diversify it.

2. It is required for buying a whole variety of assets, they may be tangible like machinery, factories, buildings, offices, or intangible such as trademarks, patents technical expertise, etc.

3. It is central to running day to day operations like buying supplies, paying bills, salaries, collecting cash from customers, etc.

4. Availability of adequate finance is very crucial for survival and growth of a business.

FINANCIAL MANAGEMENT

Financial management is concerned with management decisions relating to optimal procurement as well as usage of finance.

(a) For optimal procurement, different available sources of finance are identified and compared in terms of their costs and associated risks.

(b) Finance so procured needs to be invested in a manner that the returns from the investment exceed the cost at which procurement has taken place.

OBJECTIVES OF FINANCIAL MANAGEMENT

1. The Primary (main) aim of financial management is to maximise shareholders wealth which is referred to as the wealth maximisation concept. Wealth maximization of shareholders is possible when:

(a) Market price of equity share increases and it increases when benefits from a decision exceed the cost involved.

(b) Increase in dividend of shareholders

2. Reducing the cost of funds.

3. Keeping in mind about the risk involved and allocate funds effectively.

4. Channelizing the funds into most productive uses.

5. Optimum utilisation of funds.

Role of Financial Management:

1. Size as well as Composition of Fixed assets: Financial Management plays a significant role in determining the size and composition of fixed assets of the business. For example, capital budgeting decision to invest ` 100 crores in fixed assets would raise the size of fixed assets block by this amount.

2. Quantum of Current Assets: It helps to determine amount of current assets as well as its break-up into cash, inventories and receivables. Amount and composition of current assets depends on the level of investment in fixed assets, credit policy, inventory management, etc.

3. Amount of long-term and short-term financing: Financial management takes decision regarding the proportion of long and short-term finance. An organization raises more on long-term basis if it wants to remain more liquid. However, long-term debts adversely affect profitability as they are costly as compared to short-term debts.

4. Break-up of long-term financing into debt and equity: It helps in fixing the ratio between debt and equity in the total long-term finance.

5. All items in the Profit and Loss Account: Financial management decisions affect all the items in the profit and loss account of the business. For example, use of more debt means higher interest expense in future and use of more equity involves higher dividend payment.

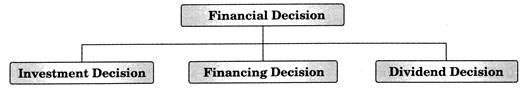

FINANCIAL DECISIONS

Financial management is concerned with the solution of three major issues of relating to the financial operations of a firm and they are Investment, Financing and Dividend decision.

Investment Decision

Investment decision, relates to how the firm's funds are invested in different assets. Investment decision can be long term or short-term.

1. Long-term investment:

(i) A long-term investment decision is also called a Capital Budgeting decision.

(ii) It involves committing the finance on a long term basis.

(iii) For example, making investment in a new machine to replace an existing one or acquiring a new fixed asset or opening a new branch etc.

(iv) It is important because of:

(a) Long term Growth: It is affected by future prospects of the business.

(b) Large Amount of Funds Involved: The decisions block large portion of capital funds. So, detailed planned analysis is required.

(c) Risk Involved: It involves investment of huge amounts which is affected by the return of the firms in long run. That is why overall business risk is high.

(d) Irreversible Decisions: If reversible huge losses are expected. So, carefully evaluate each detail before investing.

2. Short-term investment:

(i) Short-term investment decisions is (also called a working capital decisions) are concerned with the decisions about the levels of cash, inventories and receivables.

(ii) These decisions affect the day to day working of a business. These affect the liquidity as well as profitability of a business,

(iii) For sound working capital management we required efficient cash management inventory management and receivables.

Factors Affecting Capital Budgeting Decision are

(a) Cash flows of the project:

(i) When company takes an investment decision involving huge amount it expects to generate some cash flows over a period.

(ii) These cash flows are in the form of a series of cash receipts and payments over the life of an investment.

(iii) The amount of these cash flows should be carefully analysed before considering a capital budgeting decision.

NOTE:

(a) If cash inflows > cash outflows = Project feasible

(b) If cash inflows < cash outflows = Project Not feasible

(b) The rate of return:

(i) The most important criterion is the rate of return of the project.

(ii) These calculations are based on the expected returns from each proposal and the assessment of risk involved.

(iii) Suppose, there are two projects A and B (with the same risk involved) with a rate of return of 12 per cent and 15 per cent, respectively, then under normal circumstance, project B will be selected.

(c) The investment criteria involved:

(i) The decision to invest in a particular project involves a number of calculations regarding the amount of investment, interest rate, cash flows and rate of return.

(ii) There are different techniques to evaluate investment proposals which are known as capital budgeting techniques. These techniques are applied to each proposal before selecting a particular project.

Financing Decision

(i) Financing Decision is, thus, concerned with the decisions about how much founds to be raised from which source.

(ii) The main sources for funds of a firm are shareholders funds (equity shares and retained earnings) and borrowed funds (debentures).

(iii) It involves deciding the proportion of equity and debt in capital structure. Sources are analysed in light of cost of financing them as well as financial risk involved. This decision determines the overall cost of capital and the financial risk of the enterprise.

Factors Affecting Financing Decision

1. Cash flow position:

(i) Size of cash flows must be considered before issuing debt.

(ii) Company must ensure that sufficient Cash flows are expected to cover fixed cash payment obligations (interest payment and repayment of principle).

Note:

· Higher cash flow position means more debt and less equity.

· Lower cash flow position means less debt and more equity.

2. Cost: The cost of raising funds through different sources are different. A prudent financial manager would normally opt for a source which is the cheapest.

Note:

· Higher Cost of equity means more debt and less equity.

· Lower Cost of equity means less debt and more equity.

3. Risk:

(i) The risk associated with different sources is different. Debt financing is risk prone source.

(ii) The financial risk depends upon the proportion of debt in total capital.

(iii) Debt is more risky because of interest payment obligation attached.

Note:

· More debt means high risk and vice versa.

· More equity means low risk and vice versa.

4. Floatation costs: Cost of raising funds is called flotation cost. Higher the floatation cost, less attractive the source.

Note:

· More flotation cost(debt) means less debt and vice versa

· More floatation (equity) means less equity and vice versa.

5. Fixed operating cost:

· If a business has high level of fixed operating costs (e.g. building rent, Insurances premium, Salaries, etc). It must opt for lower fixed financing costs. Hence lower debt financing is better.

· If fixed operating cost is less, more of debt financing may be preferred.

Note:

· More fixed operating cost means less debt.

· Less fixed operating cost means more debt.

6. Control Considerations:

(i) Issues of more equity may lead to dilution of management's control over the business. Debt financing has no such implication.

(ii) Companies afraid of a takeover bid may consequently prefer debt to equity.

Note:

· Less control means more equity.

· More control means more debt.

7. State of Capital Markets:

(i) Health of the capital market may also affect the choice of source of fund.

(ii) During the period when stock market is rising, more people are ready to invest in equity. However, depressed capital market may make issue of equity shares difficult for any company.

Note:

· Boom means more equity and more debt.

· Depression means less equity and less debt.

Dividend Decision

(i) Dividend is that portion of profit which is distributed to shareholders.

(ii) The decision involved here is how much of the profit earned by company is to be distributed to the shareholders and how much of it should be retained in the business for meeting the investment requirement.

(iii) The main objective of dividend policy is to divide net earnings in an optimum manner so as to pay dividend and retain earnings for reinvestment with the objective of maximizing the wealth of shareholders.

Factors affecting Dividend Decision

1. Amount of earnings: Dividends are paid from current and past earnings due to which earning is the major determinant of decision about divided.

Note:

· Higher earning means more dividend.

· Lower earning means lower dividend.

2. Stability of earnings:

(i) The company who has stable earning is in a better position to declare higher dividend.

(ii) As against this, a company having unstable earnings pay smaller dividend.

Note:

· Higher stability of earning means more dividend.

· Lower stability of earning means lower dividend.

3. Stability of dividends:

· The increase in dividends is made when the earning potential has gone up.

· As against it, the dividend per share is not changed if change in earnings is small or temporary in nature.

Note:

· Higher stability of dividends means more dividend.

· Lower stability of dividends means lower dividend.

4. Growth Opportunities:

· Companies having good growth opportunity retain more from their earnings in order to finance the investment.

· Thus the dividend in growth companies is smaller than that in the non-growth companies.

Note:

· Higher growth opportunity means less dividend.

· Lower growth opportunity means more dividend.

5. Cash flow position:

(i) Dividends involve an outflow of cash.

(ii) A company may be profitable but short on cash.

(iii) Availability of enough cash in the company is necessary for declaration of dividend by it.

Note:

· Higher cash flow means more dividend.

· Lower cash flow means less dividend.

6. Shareholder preferences: Shareholder preferences must also be considered for determining the rate of dividend. There are two types of shareholders:

(i) Those who invest with the purpose of getting some regular income (i.e. Retired, old or poor shareholder). The company must declare more dividend as such shareholders expect regular and stable amount of dividend.

(ii) Those who invest in the company for capital gain (Young and Rich shareholders). The company must declare low dividend and reinvest that amount in the business for more profits in the future, which will thereby increase the stock price.

7. Taxation Policy:

(i) If tax on dividend is higher it would be better to pay less by way of dividends.

(ii) As compared to this, higher dividends may be declared if tax rates are relatively lower.

(iii) Though the dividends are free of tax in the hands of shareholders, a dividend distribution tax is levied on companies.

Note:

· Higher Tax means less dividend

· Lower Tax means more dividend

8. Stock market reaction:

(i) According investor's general view, an increase in dividend (because of bullish expectations) as a good news and hence stock price increases.

(ii) Similarly, a decrease in dividend ((because of bearish expectations) may have a negative impact on the share prices in the stock market.

Note:

· Bullish means more dividend

· Bearish means less dividend

9. Access to capital market:

(i) If the funds can be raised from the capital market easily, then the company can afford to follow a liberal dividend policy.

(ii) However, if the funds cannot be raised from the capital easily, then the company will pay low dividend to shareholders and rely more on Retained Earnings to finance their long-term projects.

Note:

· Higher Access to capital market means more dividend

· Lower Access to capital market means less dividend

10. Legal constraints:

(i) Certain provisions of the Company's Act place restrictions on payment of dividend out of profits.

(ii) Such provisions must also be considered while declaring the dividend.

Note:

· Higher legal constraint means less dividend

· Lower legal constraint means more dividend

11. Contractual constraints:

(i) While granting loans to a company, sometimes the lender may place certain restrictions on the payments of dividends in future.

(ii) Therefore the company should ensure that the payment of dividend is according to the terms of the contract.

Note:

· Higher Contractual constraint means less dividend

· Lower Contractual constraint means more dividend

FINANCIAL PLANNING

(i) Financial planning is essentially preparation of a financial blueprint of an organisation's future operations.

(ii) The objective of financial planning is to ensure that enough funds are available at right time.

The financial planning strives to achieve the following 'twin' objectives:

(a) To ensure availability of funds whenever these are required:

(i) This include a proper estimation of the funds required for different purpose.

(ii) There is need to estimate the time at which these funds are to be made available.

(iii) Financial planning also tries to specify possible sources of these funds.

(b) To see that the firm does not raise resources unnecessarily:

(i) Excess funding is almost as bad as inadequate funding.

(ii) Even if there is some surplus money, good financial planning would put it to the best possible use so that financial resources are not left idle and don't unnecessarily add to the cost.

Difference between Financial Planning and Financial Management

|

Financial Planning |

Basis |

Financial Management |

|

Financial planning is essentially preparation of a financial blueprint of an organisation's future operations. |

Meaning |

The optimal procurement as well as usage of finance is known as Financial Management. |

|

The objective of financial planning is to ensure that enough funds are available at right time. |

Objective |

Its objective is to maximise wealth of shareholders. |

|

It has narrow scope as it is one part of financial management. |

Scope |

It is wider in scope as it includes financial planning. |

Importance of Financial Planning

1. Financial Planning helps the company to prepare for the future. It tries to forecast what may happen in future under different business situations and helps to face in a better way. Financial Planning prepares alternative financial plans to meet different uncertain events.

For Example, suppose a company predicts a growth of 20% in sales. However, it is possible that the growth rate turns out to be 10% or 30%. Many items of expenses shall be different in these three situations. Financial Planning prepares a blueprint of these three situations in advance, which helps the management in deciding what must be done in each of these situations.

2. It helps in avoiding business shocks and surprises and improves the chances of financial success.

3. It helps in achieving coordination between various functions by providing clear policies and procedures.

4. It prevents duplication of efforts and gaps in planning by preparing detailed plan of action.

5. It helps to link present with future. It links the existing financial resources and future financial requirements by forecasting growth and expansion plans.

6. It provides a link between investment and financing decisions on a continuous basis. It helps in deciding proportion of debt and equity to be issued (financing decision) and how the raised funds have to be invested (investment decision).

7. It makes the evaluation of actual performance easier by clearly specifying the detailed objectives of various business segments.

CAPITAL STRUCTURE

(i) The capital structure means the proportion of debt and equity used for financing the operations of a business.

(ii) Capital structure refers to mix between owner's fund (equity) and borrowed funds (debt).

(iii) Owner's funds consist of equity share capital, preference share capital and reserves and surpluses or retained earnings. Borrowed funds can be in the form of loans, debentures, public deposits etc. These may be borrowed from banks, other financial institutions, debenture holders and public.

(iv) The right proportion of debt and equity is desired to maximize the use of funds.

(v) All decisions relating to capital structure should emphasis on increasing the shareholders wealth.

It can be calculated as:

![]()

Or, as a proportion of Debt out of total capital

![]()

Note:

· Debt and equity differ significantly in their cost and riskiness for the firm.

· Cost of debt is lower than cost of equity for a firm because lender's risk is lower than equity shareholder's risk, since lenders earn on assured return and repayment of capital and, therefore, they should require a lower rate of return.

· Additionally, interest paid on debt is a deductible expense for computation of tax liability whereas dividends are paid out of after-tax profits. Increased use of debt, therefore, is likely to lower the overall cost of capital of the firm provided that cost of equity remains unaffected.

· Debt is cheaper but is more risky for a business because payment of interest and the return of principal is obligatory for the business. Any default in meeting these commitments may force the business to go into liquidation. There is no such compulsion in case of equity, which is therefore, considered riskless for the business.

FINANCIAL LEVERAGE

(i) The proportion of debt in the overall capital is called the financial leverage.

i.e.,

![]()

where D is the Debt and E is the equity.

(ii) As the financial leverage increases, the cost of funds declines because of increased use of cheaper debt but the financial risk increases.

(iii) Companies often employ more of cheaper debt to enhance the EPS (Earning per share) such practice is called Trading on Equity.

(iv) Trading on Equity refers to the increase in profit earned by the equity shareholders due to the presence of fixed financial charges like interest.

(v) There are types of financial leverage, favourable and unfavourable leverage.

|

Favourable Financial Leverage |

Unfavourable Financial Leverage |

|

When Return on Investment (ROI) > Interest Rate Suppose, EBIT = 4,00,000 Total Investment = 30,00,000 Interest Rate = 10%

It is a favourable financial leverage as return on investment that is, 13.33% is greater than rate of interest that is 10%. Explained in detail in Example 1, next point. |

When Return on Investment (ROI) < Interest Rate Suppose, EBIT = 2,00,000 Total Investment = 30,00,000 Interest Rate = 10%

It is an unfavourable financial leverage as return on investment that is, 6.67% is lesser than rate of interest that is 10%. Explained in detail in Example 2, next point. |

(vi) The impact of financial leverage on the profitability of a business can be seen through EBIT - EPS (Earning before Interest and Taxes - Earning per Share). It can be explained with the help of following two examples:

Example 1. Suppose Company X wants to raise some money for investment purposes. The relevant facts of Company X are:

Total Funds to be raised = ` 30, 00,000

Interest rate on Debt =10%

Face value of Equity shares = ` 10 each

Tax rate = 30%

Earnings before Interest and Tax (EBIT) = ` 4, 00,000

Company X can raise ` 30 Lakhs by all equity capital or including some debt along with equity. As discussed before, use of debt increase the returns of equity shareholders. To prove this, let us consider three different situations:

Situation I: When total funds are raised through Equity

i.e. Debt = Nil; and Equity = ` 30,00,000

Situation II: When some part is raised through debt and balance from Equity

i.e. Debt = ` 10,00,000; and Equity = ` 20, 00,000

Situation III: When major part is raised through debt and some from Equity

i.e. Debt = ` 20, 00,000; and Equity = ` 10, 00,000

EBIT - EPS Analysis (Company X Limited)

|

Particular |

Situation I |

Situation II |

Situation III |

|

Total funds Capital Structure: Equity Debt |

30,00,000

30,00,000 0 |

30,00,000

20,00,000 10,00,000 |

30,00,000

10,00,000 20,00,000 |

|

EBIT 10% Interest on debt

|

4,00,000 Nil |

4,00,000 -1,00,000 (10% of 10 Lakhs) |

4,00,000 -2,00,000 (10% of 20 Lakhs) |

|

Earnings before Tax (EBT) (EBT = EBIT - Interest) 30% Tax Rate

|

4,00,000

-1,20,000 (30%of 4 Lakhs) |

3,00,000 -90,000

(30%of 3 Lakhs) |

2,00,000 -60,000

(30% of 2 Lakhs) |

|

Earnings After Tax EAT (EAT = EBT - Tax) No. of Shares Equity Funds Face Value

|

2,80,000

3,00,000

(30,00,000 10) |

2,10,000

2,00,000

(20,00,00 10) |

1,40,000

1,00,000

(10,00,000\[\div \]10) |

|

Earnings per share EPS (EPS = EAT \[\div \] No. of Shares) |

0.93 (Minimum EPS |

1.05

|

1.40 (Maximum EPS |

(a) Out of the three situations, capital structure under Situation III seems to be the best as it gives the maximum EPS of ` 1.40. In this situation, Company has used the maximum debt (or financial leverage) and the results are positive. EPS is minimum in Situation I, in which there is no debt content. Hence, it brings us to a conclusion that use of more debt increases the returns for equity shareholders.

(b) Earning per share does not always rise with increase in debt. It is possible only when Return on Investment (ROI) is more than cost of debt.

In other words: EPS will rise with increase in debt only when ROI > Cost of Debt. If

\[ROI\,\,\frac{EBIT}{Total\,Investment}\times \,100\,=\,\frac{4,\,00,\,000}{30,00,\,000}\times \,100\,=\,13.33%\]

ROI is 13.33%, whereas, cost of debt is just 10%. As ROI > Cost of debt, EPS will always rise with increase in debt.

However, when ROI is less than the cost of debt, then equity shareholders lose by use of more debt content in the capital structure.

Example 2. All details are same as of Example 1, except that EBIT of Company Y is ` 2, 00,000.

With EBIT of ` 2, 00,000 ROI of Company Y will be:

\[ROI\,\,\frac{EBIT}{Total\,Investment}\times \,100\,=\,\frac{2,\,00,\,000}{30,00,\,000}\times \,100\,=\,6.67%\]

The cost of Debt is 10% and ROI is just 6.67%. As ROI < Cost of Debt, EPS should fall with increase in debt.

EBIT - EPS Analysis (Company Y Limited)

|

Particular |

Situation I |

Situation II |

Situation III |

|

Total funds Capital Structure: Equity Debt |

30,00,000

30,00,000 0 |

30,00,000

20,00,000 10,00,000 |

30,00,000

10,00,000 20,00,000 |

|

EBIT 10% Interest on debt

|

2,00,000 Nil |

2,00,000 -1,00,000 (10% of 10 Lakhs) |

2,00,000 -2,00,000 (10% of 20 Lakhs) |

|

Earnings before Tax (EBT) (EBT = EBIT - Interest) 30% Tax Rate

|

1,40,000

-60,000 (30%of 2 Lakhs) |

3,00,000

-30,000 (30%of 3 Lakhs) |

NIL

NIL |

|

Earnings After Tax EAT (EAT = EBT - Tax) No. of Shares Equity Funds \[\div \] Face Value

|

2,80,000

3,00,000 (30,00,000 \[\div \] 10) |

70,000

2,00,000 (20,00,00 \[\div \]10) |

NIL

1,00,000 (10,00,000\[\div \]10) |

|

Earnings per share EPS (EPS = EAT \[\div \] No. of Shares) |

0.47 |

0.35

|

NIL |

As seen, EPS is NIL in situation III, which has the maximum debt. EPS is maximum in Situation I, in which there is no debt content. It happened because ROI is less than Cost of debt.

So, it brings us to a conclusion that use of more debt will increase EPS only when ROI> Cost of debt.

Size of cash flow must be considered before issuing debt. Cash Flow must also cover fixed cash payment obligation for normal business operations, for investment in fixed assets and for meeting the debt service commitments.

FACTORS AFFECTING THE CHOICE OF CAPITAL STRUCTURE

Deciding about the capital structure of a firm involves determining the relative proportion of various types of funds.

Important factors which determine the choice of capital structure are as follows:

1. Cash Flow Positions:

(a) Size of projected cash flows must be considered before borrowing.

(b) Cash flows must not only cover fixed cash payment obligations but there must be sufficient buffer also.

(c) A company has cash payment obligations for:

(i) Normal business operations;

(ii) For investment in fixed assets;

(iii) For meeting the debt service commitments i.e., payment of interest and repayment of principle.

2. Interest Coverage Ratio (ICR):

(a) The interest coverage ratio refers to the number of times earnings before interest and taxes of a company covers the interest obligation.

This may be calculated as follows:

\[ICR=\,\,\frac{EBIT}{Interest}\,\]

(b) The higher the ratio, lower shall be the risk of company failing to meet its interest payment obligations.

(c) However, this ratio is not an adequate measure. A firm may have a high EBIT but low cash balance.

3. Debt Service Coverage Ratio (DSCR):

(a) Debt Service Coverage Ratio takes care of the deficiencies referred to in the Interest Coverage Ratio (ICR).

(b) It is calculated as follows:

\[\,\,\frac{\Pr ofit\,after\,+\,Depreciation\,+\,Interest+\,Non\,Cash\,\exp .}{\Pr ef.\,Div+\,Interest\,+\operatorname{Re}payment\,obligation}\,\]

(c) A higher DSCR indicates better ability to meet cash commitments and consequently, the company's potential to increase debt component in its capital structure.

4. Return on Investment (R.O.I): If the R.O.I of the company is higher, it can choose to use trading and equity to increase its EPS, i.e., its ability to use debt is greater. A firm can use more debt to increase its EPS. R.O.I is an important determinant of the company's ability to use Trading on equity and thus the capital structure.

5. Cost of debt: A firm's ability to borrow at a lower rate increases its capacity to employee higher debt. Thus, more debt can be used if debt can be raised at a lower rate.

6. Tax Rate: Since interest is a deductible expense, cost of debt is affected by the tax rate. A higher tax rate, thus, makes debt relatively cheaper.

7. Cost of Equity:

(a) Stock owner expect a rate of return from the equity which is commensurate with the risk they are assuming.

(b) When a company increases debt, the financial risk faced by the equity holders, increases. Consequently their desired rate of return increases.

(c) It is for this reason that a company cannot use debt beyond a point. If debt is used beyond that point, cost of equity may go up sharply and share price may decrease inspite of increased EPS.

8. Floatation Costs: Process of raising resources also involves some cost. Public issue of shares and debentures requires considerable expenditure. Getting a loan from a financial institution may not cost so much. These considerations may also affect the choice between debt and equity.

9. Risk Consideration:

(a) Every business faces two kinds of risks:

(i) Business or Operating Risk, i.e., risk of inability to meet fixed operating costs (rent, salary, insurance premium, etc.)

(ii) Financial Risk, i.e., risk of inability to meet fixed financial charges (interest payment, preference dividend and repayment obligations).

(b) The total risk depends on both the business risk and the financial risk. If a firm's business risk is lower, then company may face financial risk, i.e., more debt capital can be used. However, in case of higher business risk, financial risk should be reduced by using less debt.

10. Flexibility: If a firm uses its debt potential to the full, it loses flexibility to issue further debt. To maintain flexibility, it must maintain some borrowing power to take care of unforeseen circumstances.

11. Control: Debt normally does not cause a dilution of control. Issue of equity may reduce the managements' holding in the company and make it vulnerable to takeover.

12. Regulatory Framework: Every company operates within a regulatory framework provided by the law e.g., public issue of shares and debentures have to be made under SEBI guidelines.

13. Stock Market Conditions: If the stock markets are bullish, equity shares are more easily sold even at a higher price. Use of equity is often preferred by companies in such a situation. However, during a bearish phase, a company, may find raising of equity capital more difficult and it may opt for debt.

14. Capital Structure of other Companies: A useful guideline in the capital structure planning is the debt- equity ratios of other companies in the same industry. Care however must be taken that the company does not follow the industry norms blindly.

FIXED AND WORKING CAPITAL

Investment is required to be made in fixed assets and current assets:

(a) Meaning of Fixed Assets

(i) Fixed assets are those which remains in the business for more than one year, usually for much longer e.g., plant and machinery, furniture and fixture, land and building, vehicles etc.

(ii) Decision to invest in fixed assets must be taken very carefully as the investment is usually quite large. Such decisions once taken are irrevocable except at a huge loss,

(iii) Such decisions are called capital budgeting decisions.

(b) Meaning of Current Assets: Current assets are those assets which, in the normal routine of the business, get converted into cash or cash equivalents within one year e.g., inventories, debtors, bills receivable etc.

(c) Management of Fixed Capital

(i) Fixed capital refers to investment in long term assets.

(ii) Management of fixed capital involves allocation of firm's capital to different long term assets.

(iii) These decisions are called investment decisions or capital budgeting decisions. These decisions affect the growth, profitability and risk of the business in the long run.

(iv) These long term assets yield benefits over a long period, usually more than one year.

Factors Effecting the Requirement of Fixed Capital

1. Nature of the business:

(i) The type of business has a bearing upon the fixed capital requirements.

(ii) For example, a trading concern needs lower investment in fixed assets compared with a manufacturing organization; since it does not require to purchase plant and machinery etc.

Note:

(a) Trading business have less fixed capital.

(b) Manufacturing business have more fixed capital.

2. Scale of Operations: A larger organisation operating at a higher scale needs bigger plant, more space, etc. and therefore, requires higher investment in fixed assets when compared with the small organisation.

Note:

(a) Higher scale of operation means more fixed capital.

(b) Lower sale of operation means less fixed capital.

3. Choice of Technique:

(i) Some organisations are capital intensive whereas others are labour intensive.

(ii) A capital-intensive organisation requires higher investment in plant and machinery as it relies less on manual labour. The requirement of fixed capital for such organisations would be higher.

(iii) Labour intensive organisations on the other hand require less investment in fixed assets. Hence, their fixed capital requirement is lower.

Note:

(a) Labour intensive technique requires less fixed capital.

(b) Capital intensive technique requires more fixed capital.

4. Technology Upgradation:

(i) In certain industries, assets become obsolete sooner.

(ii) Consequently, their replacements become due faster. Higher investment in fixed assets may, therefore, be required in such cases.

(iii) For example, computers become obsolete faster and are replaced much sooner than say, furniture. Thus, such organisations which use assets which are prone to obsolescence require higher fixed capital to purchase such assets.

Note:

(a) Higher technology Upgradation means more fixed capital.

(b) Lower technology Upgradation means less fixed capital.

5. Growth Prospects:

(i) Higher growth of an organisation generally requires higher investment in fixed assets.

(ii) Even when such growth is expected, a business may choose to create higher capacity in order to meet the anticipated higher demand quicker.

(iii) This entails higher investment in fixed assets and consequently higher fixed capital.

Note:

(a) Higher Growth prospects means more fixed capital.

(b) Lower Growth prospects means less fixed capital.

6. Diversification:

(i) A firm may choose to diversify its operations for various reasons.

(ii) With diversification, fixed capital requirements increase e.g., a textile company is diversifying and starting a cement manufacturing plant. Obviously, its investment in fixed capital will increase.

Note:

(a) More Diversification means more fixed capital.

(b) Less Diversification means less fixed capital.

7. Financing Alternatives:

(i) A developed financial market may provide leasing facilities as an alternative to outright purchase.

(ii) When an asset is taken on lease, the firm pays lease rentals and uses it. By doing so, it avoids huge sums required to purchase it.

(iii) Availability of leasing facilities, thus, may reduce the funds required to be invested in fixed assets, thereby reducing the fixed capital requirements. Such a strategy is specially suitable in high risk lines of business.

Note:

(a) Higher financing alternatives means less fixed capital.

(b) Lower financing alternatives means more fixed capital.

8. Level of Collaboration:

(i) At times, certain business organisations share each other's facilities.

(ii) For example, a bank may use another's ATM or some of them may jointly establish a particular facility. This is feasible if the scale of operations of each one of them is not sufficient to make full use of the facility.

(iii) Such collaboration reduces the level of investment in fixed assets for each one of the participating organisations.

Note:

(a) Higher level of collaboration means less fixed capital.

(b) Lower level of collaboration means more fixed capital.

WORKING CAPITAL/SHORT TERM CAPITAL/OPERATING CAPITAL/

CIRCULATING CAPITAL

(a) Working Capital refers to that part of total capital, which is required for holding Current assets.

(b) Current assets help in day to day operations of the business and are expected to be converted into cash within one year. Hence, it provides liquidity to the business.

(c) However, such assets attract nominal earnings. They contribute less to the profits as compared to fixed assets. Thus, it is said that working capital affects both the liquidity as well as profitability of a business.

(d) Examples of current assets, in order of their liquidity, are as under: Cash in hand/ cash at Bank, Marketable securities, Bills receivable, Debtors, Finished goods inventory, Work in progress, and Raw materials.

(e) Current liability are those payment obligations which, when they arise, are due for payment within one year. Such as bills payable, creditors, outstanding expenses and advances received from customers etc.

(f) Net working capital may be defined as the Excess of current assets over current liabilities. i.e. CA-CL. (current asset- current liabilities).

Factors Effecting the Working Capital Requirement

1. Nature of Business: The working capital requirement depend upon the nature of business.

For instance,

(i) In Small trading concern or retail shop, requirement of Working Capital is small because operating cycle period is small since:

(a) They mostly have cash sales

(b) They carry small quantities of goods in stock.

(ii) In Large Trading firms or Departmental Store dealing in large variety of goods, requirement of Working Capital is large because operating cycle period is larger since:

(a) They require large quantities of goods in stock.

(b) They carry large debtors balances.

(iii) In Manufacturing Firm, requirement of Working Capital is large because operating cycle period is larger since:

(a) They carry large quantity of raw materials.

(b) They carry large quantity of work in progress

2. Scale of operations:

(i) For organisations which operate on a higher scale of operation, the quantum of inventory, debtors required is generally high.

(ii) Such organisations, therefore, require large amount of working capital as compared to the organisations which operate on a lower scale.

Note:

(a) Higher scale of operation means more working capital.

(b) Lower scale of operation means less working capital.

3. Business cycle:

(i) In case of a boom, the sales as well as production are likely to be higher and, therefore, higher amount of working capital is required.

(ii) As against this, the requirement for working capital will be lower during period of depression as the sales as well as production will be low.

Note:

(a) Boom means more working capital.

(b) Depression means less working capital.

4. Seasonal Factors:

(i) In peak season, because of higher level of activity higher amount of working capital is required.

(ii) As against this, the level of activity as well as the requirement for working capital will be lower during the lean season.

Note:

(a) Peak season means more working capital.

(b) Lean season means less working capital.

5. Production Cycle:

(i) Production cycle is the time span between the receipts of raw material and their conversion into finished goods.

(ii) Some businesses have a longer production cycle while some have shorter one consequently, working capital requirement is higher in firms with longer processing cycle and lower in the firm having shorter processing cycle.

Note:

(a) Large Production Cycle means more working capital.

(b) Small Production Cycle means less working capital.

6. Credit allowed:

(i) Credit allowed depend upon the level of competition that a firm faces as well as the credit worthiness of their clientele.

(ii) A liberal credit policy results in higher amount of debtors, increasing the requirement of working capital.

(iii) A Tight credit policy results in Lower credit sales, lower receivables, and lower working capital.

Note:

(a) Higher Credit allowed means more working capital.

(b) Lower Credit allowed means less working capital.

7. Credit availed:

(i) The working capital requirements are also determined by the credit terms available to the firm from its suppliers of raw materials, goods, etc.

(ii) A firm will need less working capital if liberal credit terms are available to it. A firm will need more working capital if no credit or tight credit terms are available to it.

|

Case |

Working capital Requirement |

|

(a) If credit period received from suppliers > Credit period allowed to customers. |

Reduces |

|

(b) If credit period received from suppliers < Credit period allowed to customer. |

Increases |

Note:

(a) Higher Credit availed means less working capital.

(b) Lower Credit availed means more working capital.

8. Availability of raw material:

(i) If the raw materials and other required materials are available freely and continuously, lower stock level may be sufficient.

(ii) If, however, raw material do not have a record of un-interrupted availability, higher stock levels may be required.

(iii) The time lag between the placement of order and actual receipt of the materials is known as lead time.

(iv) Higher the lead time, higher the quantity of material to be stored and higher is the amount of working capital requirement and vice versa.

Note:

(a) Higher Lead time means more working capital.

(b) Lower Lead time means less working capital.

9. Operating Efficiency

(a) Firms manage their operations with varied degree of efficiency.

(b) For example, a firm managing its raw materials efficiently may be able to manage with a smaller balance. This is reflected in a higher inventory turnover ratio.

(c) Such efficiencies may reduce the level of raw materials, finished goods and debtors resulting in lower requirement of working capital.

10. Growth Prospects: If the growth potential of concern is perceived to be higher, it will require larger amount of working capital so that it is able to meet higher production and sales target whenever required.

11. Level of Competition: The extent of competition influences the working capital needs. More working capital is required in highly competitive market as firms need to maintain higher level of inventory to supply goods on time. Competition may also force them to extend liberal credit terms. However, in case of less competition, firms can manage with less working capital.

12. Inflation: Changes in the price level also affect the requirements of working capital. Rising prices would necessitate the use of more funds to maintain an existing level of production and sales. However, if the company can raise their prices proportionately, then there will be no serious problem regarding working capital. Further, rise in prices do not have a uniform effect on all commodities. It is likely that some firms may not be affected at all.

Words that Matter

1. Business finance: Money required for carrying out business activities is called business finance.

2. Financial management: Financial management is concerned with management decisions relating to optimal procurement as well as usage of finance.

3. Investment decision: Investment decision relates to how the firm's funds are invested in different assets.

4. Long-term investment decision: A long-term investment decision is also called a capital budgeting decision. It involves committing the finance on a long term basis.

5. Short-term investment decision: It is also called a working capital decisions and are concerned with the decisions about the levels of cash, inventories and receivables.

6. Financing decision: It is concerned with the decisions about how much funds to be raised from which source.

7. Dividend decision: Dividend is that portion of profit which is distributed to shareholders. The decision involved here is how much of the profit earned by company is to be distributed to the shareholders and how much of it should be retained in the business for meeting the investment requirement.

8. Financial planning: Financial planning is essentially preparation of a financial blueprint of an organisation's future operations.

9. Capital structure: It refers to mix between owner's fund (equity) and borrowed funds (debt).

10. Financial leverage: The proportion of debt in the overall capital is called the financial leverage.

11. Trading on equity: It refers to increase in profit earned by the equity shareholders due to the presence of fixed financial charges like interest.

12. Fixed assets: Fixed assets are those which remain in business for more than one year, usually for much longer e.g., plant and machinery, furniture and fixture, land and building, vehicles etc.

13. Current assets: Current assets are those assets which, in the normal routine of business, get converted into cash or cash equivalents within one year e.g., inventories, debtors, bills receivable etc.

14. Management of fixed capital: Fixed capital refers to investment in long term assets. Management of fixed capital involves allocation of firm's capital to different long term assets.

15. Working capital: Working capital refers to that part of total capital, which is required for holding current assets.

..

You need to login to perform this action.

You will be redirected in

3 sec