| What is government budget? Explain its major components. |

| Or |

| Explain (a) allocation of resources and (b) economic stability as objectives of government budget. |

Answer:

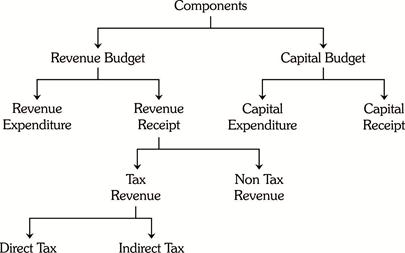

Govt. Budget: ?A government budget is an annual financial statement showing estimated receipts and estimated expenditure of the government during a fiscal year." Components of the budget: The budget is divided into two main parts: (i) Revenue Budget (ii) Capital Budget

Revenue Budget: It comprises of current revenue receipts and current expenditure met from such revenues. It includes the following components. Revenue Receipt: It includes tax revenue and non?tax revenue. Tax Revenue: Tax revenue consist of proceeds of taxes and other duties levied by the union government. It may be direct or indirect taxes. (i) Direct tax: When (i) liability to pay a tax and (ii) the burden of that tax falls on and (ii) the burden of that tax falls on the same person. The tax is called a direct tax. For ex?income tax, corporate tax etc. (ii) Indirect Tax: When liability to pay a tax is on one person and the burden of that tax falls on some other person, the tax, is called an indirect tax. For ex?custom duty, excise duty etc. Non?tax Revenue: Income from sources other than taxes is called non?tax revenue. For ex?interest, fees and fine, grant in aid etc. Revenue Expenditure: An expenditure which neither creates assets nor reduces liability is called Revenue expenditure. For ex? salaries of employees, interest, payment on past debt, subsidies pen sun etc. Capital Receipt: Government receipts which either Create liabilities or reduces assets are called capital receipts. For example Borrowings, Raising of funds from PPF and small saving deposits. Capital Expenditure: An expenditure which either creates an asset or reduces a liability is called capital expenditure. This type of expenditure adds to the capital stock of the economy and raises its capacity to produce more in future. Or (a) Allocation of Resources: To allocate resources in line with social and economic objectives, Government provides more resources into socially productive sectors where private sector is not involved eg. Sanitation, water supply, rural development, education, health etc. More? over Government allocates more funds for the production of socially useful goods and draws away resources from some other sectors to promote balanced economic growth of different regions. Moreover Govt. also undertakes production directly when necessary. (b) Economic Stability: Government can bring economic stability i.e. can control fluctuations in general price level through taxes, subsidies and expenditure. For instance, when there is inflation, govt. can reduce its own expenditure and when there is depression characterized by falling output and prices, govt. can reduce taxes and grant subsidies to encourage spending by people.

You need to login to perform this action.

You will be redirected in

3 sec