Industries: Public Sector Enterprises, Navratnas and Maharatnas

- Public Sector Enterprises (PSE) is a government-owned corporation owned by Union Government of India or one of the many state or territorial governments, or both.

- They are under the Department of Public Enterprises of Ministry of Heavy Industries and Public Enterprises.

- There are currently 254 PSU companies in India.

Financial autonomy:

- Maharatna

- Navratna

- Miniratna CPSEs (itself divided .into Category I & Category II)

As on 26 October, 2014 there are 7 Maharatna, 17 Navratna and 72 Miniratna CPSE's,

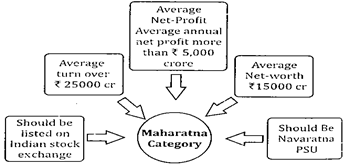

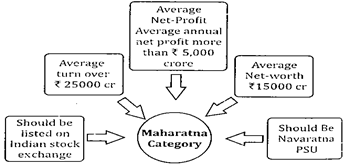

Criteria for giving

Maharatna Status:

- Company already holds Navratna status,

- It is listed on the Indian stock exchange fulfilling the minimum prescribed public shareholding according to the SEB1 regulations.

7 Maharatna CPSEs namely:

- Bharat Heavy Electricals Limited

- Coal India Limited

- Gail ( India ) Limited

- Indian Oil Corporation Limited

- NTPC Limited

- Oil & Natural Gas Corporation Limited

- Steel Authority of India Limited

Criteria for giving Navratna Status

- Company must have 'Miniratna Category - 1'status along with a Schedule 'A' listing.

- It should have at least 3 'Excellent' or 'Very Good' Memorandum of Understanding (MoU) during the last five years.

There are 17 Navratna CPSEs in the country, these are:

- Bharat Electronics Limited

- Bharat Petroleum Corporation Limited

- Container Corporation of India Limited

- Engineers India Limited

- Hindustan Aeronautics Limited

- Hindustan Petroleum Corporation

- Limited Mahanagar Telephone Nigam Limited

- National Aluminium Company Limited

- National Buildings Construction Corporation Limited

- NMDC Limited

- Neyveli Lignite Corporation Limited

- Oil India Limited

- Power Finance Corporation Limited

- Power Grid Corporation of India Limited

- Rashtriya Ispat Nigam Limited

- Rural Electrification Corporation Limited

- Shipping Corporation of India Limited

Industrial Policy 1991

(A) Objectives

- to maintain a sustained growth in productivity.

- to enhance gainful employment.

- to achieve optimum utilisation of human resources.

- to attain international competitiveness.

- to transform India into a major partner and players in the global arena.

- Main Focus on

- deregulating Indian industry.

- allowing the industry freedom and flexibility in responding to market forces, and

- providing a policy regime which facilitates and fosters growth of Indian industry.

(C) Policy Measures

- Liberalisation of Industrial Licensing Policy.

- Introduction of Industrial Entrepreneur's Memorandum [i.e. no industrial approval is required for industries not requiring compulsory licensing).

- Liberalisation ofLocationai Policy.

- Liberalised policy for Small Scale Sectors.

- Non-Resident Indians Scheme (NRIs are allowed to invest upto 100% equity on non-repatriation basis in all activities except for a small negative list).

- Electronic Hardware Technology Park (EHTP), Software Technology Park (STP) Scheme for building up strong electronic industry to enhance exports.

- Liberalised policy for Foreign Direct Investment (FDI).

- Abolition of the MRTP limit.

- FERA was replaced by highly liberal FEMA.

Major Industries in India

Classification of Industris:

- On the basis of source of raw materials

- Agro based industry (cotton textile, jute textile and sugar).

- Mineral based industry (iron and steel, machine tools and aluminium).

- On the basis of main role played by the industry

- Basic industries; these are the industries whose finished products are used as the raw materials for other industries.

- Consumer goods industries: these are the industries whose finished products are directly used for consumption by consumers.

- On the basis of capital investment

- Small scale industry

- Large scale industry

- On the basis of ownership

- Public sector undertaking

- (SAIL, HAL, BEML)

- Private sector undertaking

- (TISCO, Mahindra and Mahindra,

- Biria Cement)

- Joint sector undertaking

- (Oil India Limited]

- Co-operative industries

- (Sugar Industry in Maharashtra)

- Based on the bulk of raw materials and finished products

- Heavy industries

- Light industries

In India, industries are concentrated in four main regions:

- West Bengal, Jharkhand and Chhatisgarh

- Maharashtra and Gujarat region

- Gangetic Plains

- South India

First Time in India

Cotton Industry 1818 Fort Gloster (Kolkata)

Iron and Steel 1870 Kulti (West Bengal)

Industry

Sugar Industry 1900 Bihar

Jute Industry 1855 Rishara (West Bengal)

Paper Industry 1812 Serampur (W.Bengal)

Petroleum Industry - 1956 Digboy (Assam)

Cement Industry 1904 Chennai (Tamil Nadu)

Agro-based Industries of India:

These industries depend on agricultural products as raw materials for the manufacturing products.

Cotton Textile Industry

- Mumbai is called the Manchester oil India, for the large concentration of cotton mills in and around the city.

- India is one of the leading producers of cotton textile, ranking third in the world.

Jute Industry

- India is the largest producer of raw jute and jute goods and is the second largest exporter after Bangladesh Also faces competition from Brazil and Thailand.

- Most of the 70 jute mills are located on the 98 km belt on both sides of River Hooghly in West Bengal.

Sugar Industry

- India ranks second in the world in the production of sugar and first in producing gur and khandsari.

- Major sugar producing states: Maharashtra, UP, Gujarat, Bihar, MP, Haryana, Karnataka, Andhra Pradesh and Tamil Nadu.

- Problems faced: seasonal nature transport delays, outdated and inefficient machineries.

Paper Industry

- Major centres are Kolkata, Titagarh Kakinada and Bhadravati.

- India's production falls short of the demand.

- A large quantity of paper has to be imported.

Mineral-based Industries of India

Iron and Steel Industry

- India ranks 5th in the world in steel production and first in the production of sponge iron.

- Most of the steel plants are controlled by Steel Authority of India Limited (SAIL) that was established in 1974 and is responsible for development of steel industry.

- First large scale steel plant TISCO at Jamshedpur in 1907 followed by IIS- CO at Burnpur in 1919. Both belonged to private sector.

- The first public sector unit was' Vishveshvarraya Iron and Steel Works' at Bhadrawati.

- Bhilai, Durgapur and Rourkela were established during the second five year plan. Bokaro was established during the third five year plan while the steel plants at Salem, Vijay Nagar and Vishakhapatnam were established in the fourth five year plan.

Aluminium Smelting

- It is the second most metallurgical industry in India.

- There are eight aluminium smelting plants in India.

Chemical and Fertilizer Industry

- India ranks 12th in the world in the production of different types of chemicals.

- India is the third largest nitrogenous fertilizer producer of the world.

- India exports cement to South and East Asia, Middle East and Africa.

Committees on Indian Economy

|

AC Shah Committee

|

Non-Banking Financial Company

|

|

Bimal Jalan Committee

|

Market Infrastructure Instruments

|

|

Malegam Committee

|

Functioning of Micro Finance

|

|

Biria Committee

|

Corporate Governance

|

|

Kirit Parikh Committee

|

Rationalisation of Petroleum Product Prices

|

|

Chaturvedi Committee

|

Improving National Highways in India

|

|

SR Hashim Committee

|

Urban Poverty

|

|

Abhijit Sen

|

Wholesale Price Index

|

|

C Rangarajan

|

Services Price Index

|

|

Abid Hussain Committee

|

Development of Capital Markets

|

|

Damodara Committee

|

Customer Service in Banks

|

|

Khandelwal Committee

|

Human Resource in Commercial Banks

|

|

Patil Committee

|

Corporate Debt

|

|

VK Sharma Committee

|

Credit to Marginal Farmers

|

|

Sarangi Committee

|

Non-Performing Assets

|

|

Khanna Committee

|

Regional Rural Banks

|

|

Dantawala Committee

|

Lead Bank Scheme

|

|

Gadgil Committee

|

Financial Inclusion

|

|

|

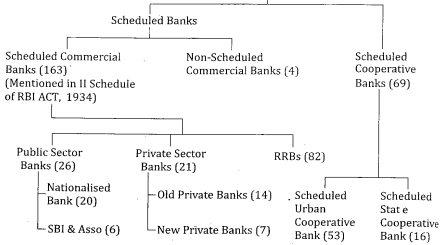

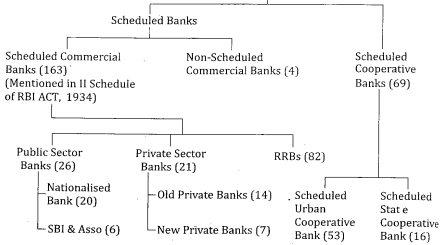

Banking in India

History: Banking System of India

Bank of Hindustan (1770) first bank to be established in India at Kolkata under European Management.

Bank of Bengal (1806)

Bank of Bombay (1840)

Bank of Madras (1843) called as Presidency Banks

Oudh Commercial Bank(1881): first bank with limited liability managed by an Indian board.

Punjab National Bank (1884): First purely Indian Bank.

The State Bank of India is the largest commercial bank in India.

Reserve Bank of India

- Central bank of India.

- Established on April 1, 1935 with a capital of Rs.5

- Nationalised on January 1, 1949 as Government acquired the private share holdings.

- Administration: 14 Directors in Central Board of Directors besides the Governor, 4 Deputy Governors and 1 Government official. The Governor is the Chairman of the Board and Chief Executive of the Bank.

Reserve Bank of India

- Governors: 1st Governor - Sir Smith (1935-37); 1st Indian Governor- CD Deshmukh (1948-49).

- RBI follows Minimum Reserve System worth 200 crore (Rs. 115 crore gold & Rs.85 crore bond).

- All notes except one rupee are issued by the RBI & bear the signature of RBI Governor.

- Where as the one rupee note bears signature of Secretary of Finance.

- No personal accounts are maintained & operated in RBI.

Functions of RBI

- Issuance of note.

- Banker to the Government.

- Banker's Bank.

- Controller of Credit

- Custodian of Foreign Reserves

- Formulates and administers the monetary policy.

- Acts as the agent of the Government of India in respect to India's membership of the IMF and the World Bank.

- RBI acts as the central clearing house for the inter bank transactions.

- Credit control means control over the quantity and value of credit in the country. Among the functions of Central Bank, one main function is to control and regulate the credit in the country. In India, this function is performed by the Reserve Bank. The measures of credit control can be divided into two types:

- Quantitative Credit Control:

- Bank Rate, Cash Reserve Ratio (CRR), Open Market Operations (OMO), Statutory Liquidity Ratio (SLR), Repo/ Reserve Repo.

- Qualitative Credit Control:

Rationing of Credit, Regulation of Credit for Consumption Purpose, Variation of margin requirements, Moral Control, Direct action. The main objective of quantitative credit control is to establish control over the total quantity of credit in the country.

Printing of Securities and Minting in India

India Security Press (Nashik Road):

Postal Material, Postal Stamps, Non- postal Stamps, Judicial and Non-judicial Stamps, Cheques, Bonds, NSC, Kisan Vikas Patra, Securities of State Governments, Public Sector Enterprise and Financial Corporations. Currency Notes Press (Nashik Road):

Since 1991, this press prints currency notes of Rs. 1, Rs. 2, Rs. 5, Rs. 10, Rs. 50, and Rs. 100.

Bank Notes Press (Dewas): Currencynotes of Rs 20, Rs 50, Rs 100 and Rs 500 are printed here.

Modernized Currency Notes Press:

Two new modernized currency notes press are under establishment at Mysore (Karnataka) and Salboni (West Bengal).

Security Paper: Hoshangabad (established in 1967-68) makes production of Bank and Currency notes paper.

Coins are minted at four places: Mumbai, Kolkata, Hyderabad and Noida.

- Banking, financial sectors and insurance (BFSI), together accounts for 38 percent of India's outsourcing industry.

- FDI limit in Private Sector Banks has been raised to 74% under the automatic route including investment by FIIs (Foreign Institutional Investors).

Stock Exchange of india

- The Securities Contracts (Regulation) Act of 1956 defines, a stock exchange as "an association, organisation or body of individuals, whether incorporated or not, established for the purpose of assisting, regulating and controlling, business in buying, selling and dealing in securities."

- There are 24 stock exchanges in India.

Bombay Stock Exchange 1875 one of the oldest in the world and oldest in Asia.

Madras Stock Exchange-1920

Ahmedabad Stock Exchange-1894

Calcutta Stock Exchange-1908

Securities and Exchange Board of India (SEBI): April 1988

- There is also an Over 1 tie Counter Exchange of India [OTCEI] which allows listing of small and medium sized companies.

- SEBI

- Securities and Exchange Board of India.

- It was given statutory status and powers through an ordinance promulgated on January 30,1992.

- It is managed by six members.

- 1 chairman nominated by Central Government.

- 2 members (officers of Central Government)

- 1 member [from RB1)

- 2 members nominated by Central Government.

- Its office is situated in Mumbai with regional offices at Delhi, Chennai and Calcutta.

- It has all the statutory powers for regulating Indian Capital Market.

- Initial capital of SEBI was 7.5 crore provided by its promoters- ICICI, IDBI, IFCI.

Functions of SEBI:

- Check insider trading of securities.

- Encourage self-regulatory organisations.

- Eliminate malpractice of security market.

- Safeguard interests of investors.

- Regulate capital market with suitable measures, etc.

- Share sensex of Bombay Stock Exchange [BSE) includes 30 shares.

- Share sensex of National Stock Exchange [NSE) includes 50 shares.

Agriculture

The agriculture sector of India occupies almost 43 per cent of India's geographical area.

Importance of Agriculture in Indian Economy

- It is the largest contributor to India's GDP.

- Provides livelihood to 65-70% of total population and employment to 58.4% of total work force.

- Importance source of raw materials to large and small scale industries,

- Agriculture accounts for 14.7% of total export earnings.

- Agriculture and related products contribute to 38% in total exports of the country.

National Agricultural Policy

The major features of the new agricultural policy are:

- Over 4% annual growth rate aimed over next two decades.

- Greater private sector participation through contract farming.

- Price protection for farmers.

- National agricultural insurance scheme to be launched.

- Dismantling of restrictions on movement of agricultural commodities throughout the country.

- Rational utilization of country's water resources for optimum use of irrigation potential.

- High priority to development of animal husbandry, poultry, dairy and aquaculture.

- Capital inflow and assured markets for crop production.

- Exemption from payment of capital gains tax on compulsory acquisition of agricultural land.

- Minimize fluctuations in commodity prices.

- Continuous monitoring of international prices.

- Plant varieties to be protected through a legislation.

- Adequate and timely supply of quality inputs to farmers.

- High priority to rural electrification.

- Setting up of agro-processing units and creation of off-farm employment in rural areas.

Minimum Support Price for Agricultural Products

Government has been announcing MSP of 24 major crops on the basis ofrecommendations by Agriculture Cost and Price Commission (ACPC). Market price of the crop never comes down the MSP.

Objectives:

- To prevent fall in prices in case of over production.

- To protect interests of the farmers.

Food grains procurement and Stocks in India

Food grains procurement by government serves two purposes- providing support price to the farmers and building up public stocks of food grains. It is carried by Food Corporation of India (FC1).

Food stocks are maintained by Central Government for:

- Meeting the prescribed minimum buffer stock norms for food security.

- Monthly release of food grains for supply through public distribution system.

- Market intervention to augment supply so as to help moderate the open market prices.

Green Revolution in India

- The term 'green revolution' was given by American scientist- Dr. William Gande.

- The credit of Green Revolution goes to Norman Borlaug (Mexico) and Dr. M.S. Swaminathan in India.

- In India, it is associated with the use of high yielding variety seeds (HYVS), chemical fertilizers and new technology which led to sharp rise in agricultural productions during the middle of 1960s.

Second Green Revolution in India

- Strategy adopted in Eleventh Plan.

- It aimed at efficient use of resources and conservation of soil, water and ecology on a sustainable basis and in a holistic framework.

Agricultural Holdings in India

|

Type

|

Holding (in hectares)

|

(% of Total)

|

|

Marginal holding

|

Less than one

|

59%

|

|

Small holding

|

1-4

|

32.2%

|

|

Medium holding

|

4-10

|

7.2%

|

|

Large holding

|

More than 10

|

1.6%

|

|

Other Revolutions

|

|

Revolution

|

Area

|

|

Yellow Revolution

|

Oil Seeds

|

|

White Revolution

|

Milk

|

|

Blue Revolution

|

Fish

|

|

Pink Revolution

|

Shrimp

|

|

Grey Revolution

|

Fertiliser

|

|

Golden Revolution

|

Horticulture

|

White Revolution and Operation Flood in India

- India stands first in the world in the milk production.

- Buffaloes, Cows and Goats contribute 50 %, 46% and 4% raspectively in total milk production of the country.

- Varghese Kurien is the pioneer of operation flood in India.