Fiscal and Monetary Policy

Category : UPSC

Fiscal and Monetary Policy

Introduction

Fiscal Policy deals with the taxation and expenditure decisions of the government covered in the annual budget.

Monetary Policy deals with the supply of money in the economy and the rate of interest. In India, the government deals with fiscal policy, while the Central bank (RBI) is responsible for monetary policy.

Fiscal policy

Fiscal policy or budgetary policy refers to the use by the government Finance Ministry of the various instruments such as taxation, expenditure and borrowing in order to achieve the objectives of balanced economic development, full employment and to establish a welfare state. In the context of economic liberalization, the major themes of the fiscal policy comprises:

(1) a systematic effort to simplify tax structure and tax laws

(2) a deliberate move to a regime of reasonable direct tax rates and better administration and enforcement.

The budget or the annual financial statement of the government gives expression to its fiscal policy. Under Article 112 of the Indian Constitution, the President shall cause to be laid, before both the Houses of Parliament a financial statement at the commencement of every financial year. The General Budget is presented in Lok Sabha by the Minister of Finance.

Union budget or Annual financial statement is a statement of estimated receipts and expenditures of the Government of India. It has to be placed before Parliament for every financial year, i.e. April 1 to March 31 & presented at 11 a.m. on the First day of February. The decision to advance the date of the general budget from the last working day of February to the first working day of February was taken in 2017, to ensure that the proposals take effect from 1st April. The practice of presenting a separate Railway Budget as also discontinued from 2017.

The annual financial statement gives the following details:

(a) An outline of the results of the last financial year compared with the previous budget estimates.

(b) Government forecasts of receipts and payments for the next year.

(c) Proposed changes in taxes and expenditure allocations. For instance, the Government can change the proportion of revenue collected from direct taxes and indirect taxes or it might increase public expenditure on defence and decrease that of social services, the budget shows the receipts and payments of the Government under three heads:

(i) Consolidated fund

It consists of all revenues and loans received by the government. Article 114(3) of the Constitution declares that no money can be taken out of Consolidated Fund on India without the approval of the Lok Sabha.

(ii) Contingency fund

It comprises of the sum placed at the disposal of the President to meet unforeseen expenditure.

(iii) Public Account

It consists of receipts and payments, which are in the form of deposit account with the Government, such as provident funds, small savings, etc.

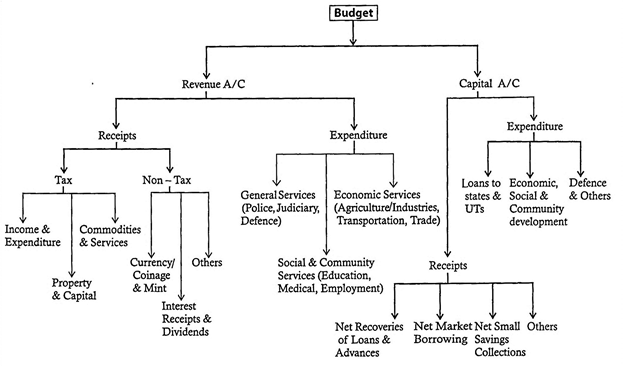

Parts of the Budget

There are two parts of budget, i.e. Revenue Account and

Capital Account.

Revenue Account contains all current receipts, such as taxation, (central excise, custom duty, corporation tax) dividends of public sector units (PSU's) and expenditure of the Government.

Capital Account consists of all capital receipts and expenditure such as domestic and foreign loans, loan repayment, loans to foreign governments etc.

Expenditure

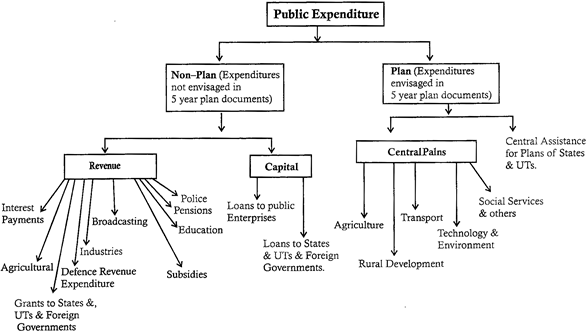

Total expenditure of the government can be classified into two categories- Developmental or Non-developmental.

Developmental expenditure includes government spending with the aim of creating economic and social infrastructure like transport, roads, communication, hospitals, school, etc.

Non-developmental expenditure does not directly contribute to development of economy, for example expenditure for loan repayment, interest payable on internal and external loans, defence expenditure, subsidies, etc. In the Indian budget management, this classification was used before 1987-88.

The Central Government adopted a new classification of public expenditure from 1987-88 budget. Under this new classification all public expenditure is classified into-(a) Plan Expenditure and (b) Non-Plan expenditure.

Plan Expenditures

Expenditure on central plans such as agriculture, rural development, irrigation, transport, communications, environment and welfare schemes are considered plan expenditure.

Non-plan Expenditure

Non-plan expenditure is further divided into Revenue expenditure, which includes interest payments, subsidies, defence expenditure and Capital expenditure, which includes loans to PSUs, states, foreign governments.

In short, all asset creating and productive expenditure is part of plan expenditure, and all non- productive, consumptive and non- asset building expenditure is part of non- plan expenditure.

On the recommendations of the Sukhomoy Chakravarti Committee, from the financial year 1987-88, Indian budget started being classified as plan and non-plan expenditure, instead of developmental and non-developmental.

From the financial year 2017-18, the budget has abolished the distinction of plan and non-plan expenditure. The plan and non-plan expenditure heads created distortions in developmental funding. This classification had given rise to a misleading nation that plan expenditure was developmental and non-plan expenditure was non-developmental. This nation led to an excessive focus on plan expenditures, with a corresponding neglect of items such as maintenance that were classified as non-plan.

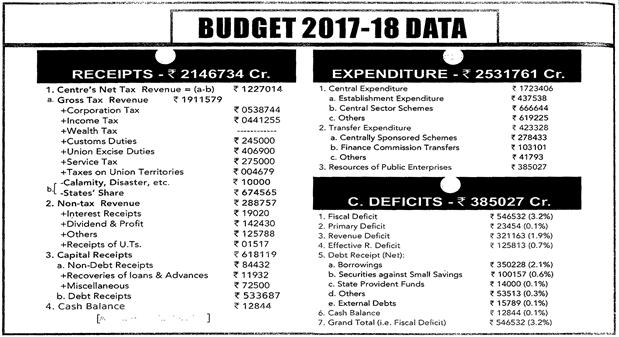

Deficit

It means shortage. The gap between Revenue and Expenditure is called Deficit.

Types of Deficit

Revenue deficit means the excess of current revenue expenditure over current revenue receipts. Revenue deficit indicates that the government cannot meet its current expenditure from its current revenue.

|

Revenue Deficit = Revenue expenditure - Revenue receipts |

Budget deficit is the overall deficit, i.e. the excess of total expenditure over total revenues. It includes both capital and revenue items in receipts and expenditure. Traditionally, deficit financing in Indian budgets had meant filling this gap.

|

Budget Deficit = Total expenditure - Total receipts

|

Fiscal deficit is budget deficit plus borrowings and other liabilities. Previously, when budgetary deficit was the prime consideration, borrowings from the market and receipts from national savings, provident funds, etc. were being treated as capital receipts. To this extent, government's actual deficit was being understood. In other words, fiscal deficit indicates the total borrowing requirements of the government from all sources, whereas budgetary deficit only indicated government's borrowing from RBI.

|

deficit =Revenue receipts (net tax revenue and non-tax revenue capital receipts (only recoveries of loans and other receipts) Total expenditure (Plan and non-plan) |

Or

|

Fiscal deficit =Budget deficit +Government?s market borrowing and liabilities. |

The fiscal deficit situation shows whether the government is spending beyond its income. India has, unfortunately, been a country prone to constant and high fiscal deficit situations. A high fiscal deficit implies high indebtedness of the government and a deficit above 3 % in the Indian context means an alarming situation for the government finances.

In India, a high fiscal deficit is mainly due to high revenue deficit which implies that it is mainly due to the government?s day to day expenditure being more than its day to day income, such that it has to borrow to meet its daily requirements which, by definition, is unhealthy and dangerous, because borrowing is good only if it is for productive purposes. Hence, the FRBM Act, 2003 laid down?s that the government's revenue deficit should be brought down to zero and its fiscal deficit should not be allowed to exceed 3% of the GDP by 2008-09.

The Fiscal Responsibility & Budget Management Act. 2003 (FRBMA) is an Act of Parliament of India to institutionalize financial discipline reduce India's fiscal deficit improve macroeconomic management and overall management of public funds by a balanced budget. The FRBM Act 2003, was mirrored by Fiscal Responsibility Legislation (FRL) adopted in the states. The center?s fiscal deficit reduced from 3.9% in 2004-05 to 3.1 % in 2007-08. The financial position of states also improved considerably after 2005. The average revenue deficit was entirely eliminated, while me average fiscal deficit was curbed to less than 3% of GDP.

However at the time of recession the government decided to go for counter-cyclical measures.

As a result the fiscal deficit increased to 6% of GDP in Q08-09 Later, the targets were revised in 2012 and 2015. The concept of effective revenue deficit was introduced in 2011. As per the amendment in 2012 the Central Government had to take reduce fiscal deficit, revenue deficit and eliminate effective revenue deficit by 31st March 2015. As per the Finance Act 2015, the target dates for achieving me prescribed rates of effective revenue deficit and fiscal deficit (3%) were further extended by 3 years to March 2018. As per budget 2016-17 the government constituted a committee to review the implementation of FRBM Act.

A high fiscal deficit is also inflationary because it is mainly due to the government's high non plan expenditure which is unproductive. Besides, a high fiscal deficit imposes huge burden by way of repayment of interest and principal. As such, the Kalkar panel in 2012 on fiscal consolidation recommended a series of measures like disinvestment, raising diesel prices, auction of spectrum, pruning some plan schemes and rationalising of subsidies.

|

Primary Deficit = Fiscal Deficit-Interest Payments. |

India started using this term since 1997-98. Primary deficit is considered a very useful tool in helping bring more transparency in the government's pattern of expenditure. It shows the current state of government finances. If interest payments are deducted from fiscal deficit, then it will obviously show a lesser deficit for that year as the interest payments are on account of loans taken in the past and not in the present year.

Monetised deficit refers to that part of deficit for which the government borrows from the RBI. To meet the governments such requirements, the RBI prints fresh currency, as a result of which the economy gets monetised. This term was adopted by India in 1997-98,

The 2005-2006 Indian Budget introduced a statement highlighting the gender sensitivities of the budgetary allocations. Gender budgeting is an exercise to translate the stated gender commitments of the government into budgetary commitments, involving special initiatives for empowering women and examination of the utilisation of resources allocated for women and the impact of public expenditure and policies of the government on women.

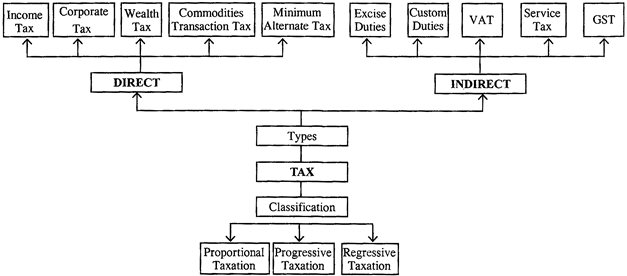

Taxes

Taxes are the main source of government revenues. The primary purpose of taxation is the mobilisation of resources and channelising the same for productive investment. Taxation can also be used as a measure to promote equity and reduce disparities or to encourage or discourage consumption of particular items. Taxation is in the nature of a compulsory levy and there is no quid pro quo between the amount paid and the services provided by the government.

Taxes are broadly divided into two - direct and indirect.

Taxes like income tax and property tax are direct taxes, while excise duty and sales tax are examples of indirect taxes. The difference between the two is that in the case of direct taxes the burden or ?incidence? has to be borne by the taxpayers themselves whereas in the case of an indirect tax, the burden can be shifted to another person. For example, a trader who is the assessee in the case of sales tax shifts the burden on to the purchasers by recovering the sales tax from them.

Another difference between indirect and direct taxes is that the rich and the poor will have to pay the same rate of indirect tax while a direct tax can be made progressive by prescribing different rates of tax for different income levels.

Taxes can also be categorized as progressive, regressive and proportional taxes.

(1) Progressive Tax

Progressive tax means rates of tax increase for increasing values or volumes on which the tax is levied.

Income tax is a progressive tax as it has exemptions for very small incomes, low rates for the first slab of taxable income, and higher rates for the largest incomes.

Indirect taxes can be progressive if there are exemptions or low tax rates for goods heavily consumed by me poor, and higher rates on luxury items, mostly consumed by the rich.

India has adopted this system for income tax. This is pro-poor way of taxation and is popular in the whole world.

(2) Regressive tax

Regressive tax is one where the proportion of tax paid falls as income rises.

The most regressive tax is a poll tax, levied at a fixed rate per person regardless of income. A tax system can be made regressive by having indirect taxes levied at relatively high rates on goods heavily consumed by the poor.

(3) Proportional Tax

Proportional tax is one by which the revenue collected rises proportionally with income. A tax system could be made approximately proportional by having a uniform rate of income tax with very few exemptions, and indirect taxes levied at similar rates on as many goods and services as possible.

At some level, progressive and regressive taxes have to be made proportional, otherwise there will be no limit to increase or decrease as the case may be.

Indian Tax Structure

(A) Direct taxes

Income Tax

It is the tax levied directly on the income of the people by the Central Government.

Corporation taxw

It is the tax on income (profit) of the companies. In 1996, government introduced Minimum Alternate Tax (MAT) on companies which escaped the corporation tax net by using the provisions of exemptions, deductions, incentives, depreciation and so on.

(B) Indirect Taxes

Central excise duty

The commodities which are produced within the country levied by central excise duty. However, commodities on which state governments impose excise dunes (e.g. liquor, drugs) are exempted from the central excise duty. In recent years large number of goods have come under excise duty. Moreover, the rates of these duties have also been increasing.

Customs duty

It is the tax imposed on commodities imported into India (import duty) or those exported from India (export duty).

Since imposing duties on exports reduced the competitive position of the country, the government withdrew export duties. In recent times, there has been considerable increase in revenue from import duties because of heavy imports of iron and steel, petroleum products, chemicals, etc. In the new requirements under WTO, import duty will be the only means to curb inputs.

Custom duty had been the largest revenue generator since independence. But in recent years the corporate tax has overtaken the custom duty as the largest revenue earner.

Service tax

It is a tax imposed on the person, who avails any specified service. It was introduced in 1994-95 to address the asymmetric and distortionary treatment of goods and services in tax framework and to widen the tax net. The number of services liable for taxation was raised from 3 in 1994-95 to 119 in 2011-12. However, this concept of a list of services liable for taxation was changed by the Budget 2012. In this budget, the government revamped the taxation provisions for services by introducing a new system of taxation of services in India. In the new system all services, except those specified in the negative list, are subject to taxation. In budget 2016, government has imposed acess called Krishi Kalyan cess @ 0.5% on all taxable services, making effective service tax rate as 15%.

Value Added Tax (VAT)

It was first introduced in France in 1950s to overcome the cascading effect of several taxes-from raw material to the final product in the process of production. In VAT, the tax on all inputs can be deducted from the tax paid on the output, so that taxes are levied only on the value added to each stage in the production process. VAT system of taxation has been adopted in more than 150 countries including Australia and Canada. The main advantage of VAT over any other form of indirect tax is that it shifts the tax base towards the point of final consumption from the first point of sale. It thus ensures the ?tax neutrality? of the production decisions. VAT was introduced in India in 2005. The basic features of the tax include 2 rates of 4% for common consumption commodities and inputs and 12.5% for the others. Some essential items are exempted and precious metals are taxed at 1 %.

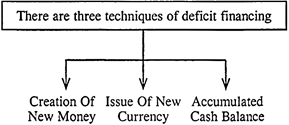

Deficit Financing

The process of bridging the gap between the revenue and expenditure is called deficit financing. In other words, Deficit financing refers to the ways in which the budgetary gap is financed.

Deficit financing was first done in the USA in 1930s as a tool to get out of the effects of the Great Depression. India tried this in 1969 and it gradually became a routine phenomenon in Indian fiscal management.

Objectives of Deficit financing

1. It is used as a tool for meeting financial needs of government, especially in times of war.

2. In under-developed countries, deficit-financing has been considered essential for financing the plans of economic development.

3. It is used for the mobilisation of surplus, non- utilised and idle resources in the economy.

4. It is used as an instrument of economic policy for removing the conditions of depression and to raise the level of output and employment.

Public debt

Budgetary deficits must be financed by either taxation, borrowing or printing currency notes. Governments have mostly relied on borrowing, giving rise to what is called government debt. Public debt has three components:

(i) Internal debt; It includes market loans from banks and financial institutions, short-term borrowings on treasury bills and other bonds and certificates issued by the government.

(ii) Other internal liabilities: It includes small saving schemes, provident fund, reserve fund of the railways, post and telegraph on which the Central Government has to pay interest.

(iii) External debt: It includes loan from foreign countries and international financial institutions like the World Bank, IMF, ADB, etc.

External aid and borrowings

A developing country often resorts to foreign aid if it finds that domestic sources are not large enough. But a country going for foreign aid has to take two precautions:

(i) Keeping the borrowing level low so that country does Not fall in a debt trap, and

(ii) Keeping foreign aid strings-free.

External grants and borrowings are different things. External aids and grants may come free or with very low or even zero interest rates. However, these may come with many terms and conditions attached which are usually not good for a country?s economy and autonomy. External borrowings mean taking loans from other countries. External borrowing is often preferred as it brings foreign currency which may help the government in various ways. It is also preferred over internal borrowings because if the government itself starts borrowing from the banks of the country, there might not be enough left for other borrowers.

Intemai Borrowings

These are not usually preferred because they might hamper the investment scenario of the public and corporate sector of India, but, it may be resorted to as and when required.

Printing currency

It is usually the last resort for '[lie government in managing its deficit. It might help the government in times of need hut it should be undertaken only in case of extreme necessity as it lies many damaging effects on the economy. It increases inflation proportionally. It may also lead to a pressure on the government for an upward revision in salaries of government employees, which in turn will lead to an increase of government's expenditure, further necessitating printing of currency and more inflation. Thus- it may begin a vicious cycle. Moreover, it also has the obvious drawback in me tact that it cannot help in case of expenditures that are or be done in foreign currency.

Black Money

It is unaccounted money which is concealed from tax authorities.

All illegal economic activities are dealt with this Black Money.

Hawala market has deep roots with this black money. Black money creates parallel economy. It puts an adverse pressure on equitable distribution of wealth and income in the economy.

Some of the reasons for the spread of black money in India are:

· The shortage and consequent black marketing during the war years and the troubled days of partition;

· The launching of the five-year plans with large expenditure on projects and the consequent enlargement of bureaucracy;

· The regime of controls over economic activity providing scope for corrupt practices;

· Heavy taxation and cumbersome procedures which prompt the evasion;

· Rent control and other regressive laws which led to concealment of actual values in real estate transaction;

· Dishonest foreign trading involving under-invoicing of exports and over-invoicing of imports;

There are numerous deleterious effects of black money. It distorts the real picture of the economic system. It leads to investment of scarce resources in unproductive areas such as real estate, bullion and precious stones. It acts against the poor and those with fixed incomes. Most importantly, the existence of black money distorts the value system of the society and affects the moral fabric of the society in the long run.

There is no one solution for the evils of black money. The most obvious remedy is to simplify the tax structure so that from a feeling of extortion, the taxpayer is made to feel a sense of participation in nation building. This requires considerable scaling down of the rates and easy settlement of pending cases.

Easing of import controls, especially of quantitative types, and allowing liberal import of consumer goods subject to payment of duty is another measure. Removal of restrictive laws like rent control and urban land ceilings, which have only encouraged the generation of black money, will obviate the need for entering into concealed transactions.

|

The Black Money and Imposition Act, 2015, which came into effect from 1 July, 2015, lends 90-day s compliance window. This gives the person having undisclosed foreign assets and income, a chance to come clean by declaring all such assets and paying a total of 60% tax and penalty.

|

General Anti Avoidance Rules (GAAR)

GAAR has been introduced as a very important component of Direct Tax code with the objective of preventing such deals and transactions that are carried out to evade and avoid paying taxes. In other words, GAAR seeks to prevent such transactions that are carried out by way of aggressive tax planning so as to avoid paying taxes. GAAR has been prompted by practices of 'round-tripping' whereby a company operating in India may deliberately incorporate its office in a tax haven country, moves its assets there and invests back in India, thereby avoiding paying tax in India.

The announcement to implement GAAR from 2012-13 aused panic among foreign investors and led to massive outflow of foreign funds, which led the government to set up Shome Committee to review GAAR. The Committee recommended, among other things, postponement of GAAR and also recommended that it should not be imposed on investments from Mauritius and Singapore. It also recommended that GAAR should not be imposed if the tax liabilities are less than 3 crores. It also suggested doing away with the arbitrary powers given to tax authorities in India.

|

GST: A Powerful Source to Curb Black Money and Corruption in India |

India is notorious for its complex tax system. Presently, the Constitution empowers Central Government to levy excise duty on manufacturing and service tax on the supply of services. It empowers the State Governments to levy sales tax or value added tax (VAT) on the sale of goods. This division of fiscal powers has given birth to a complex multiplicity of indirect taxes in the country. In this complex system, it becomes impossible for government to navigate through various direct and indirect taxes for new businesses and startups.

In current indirect tax structure, there is cascading of taxes due to ?tax on tax?. At manufacturing stage, no credit of excise duty and service tax paid is made available to the traders while paying the State level sales tax or VAT, and vice versa.

Furthermore, no credit of State taxes paid in one State can be availed in any of the other States. Hence, this leads to artificial inflation of taxes to the extent of tax on tax. Constant changes to taxes like Service Tax make things even worst. Now, things are set to change with new Goods and service tax regulation-called GST bill.

What will the GST do?

Right now taxes are managed differently by the Centre and State Governments. There are taxes like, customs duties, central excise duty and service tax at the central level, and VAT (value-added tax), luxury tax, lottery taxes or entertainment tax at the state level on the same commodity or service. This results in making the goods and services costlier. With GST, the tax base will be comprehensive. That means all goods and services will be taxable, with minimum exemptions.

GST: The Game Changer

GST will be a revolutionary reform for the Indian economy.

By creating a common Indian market, GST will reduce the cascading effect of tax on the cost of goods and services. Since GST collects taxes only at the purchase level, it may reduce the overall cost of goods manufacturing or running the business.

Along with tax compliance, it will impact the tax structure, tax computation, tax payment, credit utilization and reporting. It may result in a complete overhaul of the current indirect tax system. Accounting to all the above mentioned factors attached to GST, it will result in reducing corruption and inflow of black money that exists in the current tax system.

Existence of black money in the current tax system

There are certain means through which black money is generated in present tax system. For instance, VAT, excise, and service tax are not reported to the tax department. As a result, incomes through such transactions go unrecorded in the income book. It benefits tax defaulters by conveniently avoiding paying direct as well as indirect.

Sometimes, to save taxes illicitly, both traders and customers indulge in transactions through kaccha and pakka bills. Such bills are written on a plain piece of paper and are never accounted for. Currently, VAT charges on goods are somewhere between 5% and 20%, depending on the type of the product and in conformity with state law. However, the Government misses out on such incomes. Considering mutual benefits, traders aim at increasing their margin by skipping the tax net and customers go for lowering their product cost.

How unaccounted transactions affect the business ecosystem

Entrepreneurs lower product costs through unaccounted transactions. Indulgence of entrepreneurs in illegitimate activities gives birth to poor quality of goods. This unhealthy practice impacts the entire business ecosystem. Currently, the tax rates on commodities vary from one state to another.

Traders are bound to pay central sales tax on buying goods from another state. Owing to the system of different tax levels across states, people give in to various illegal means in order to avoid paying taxes.

How would it account for black money?

A well implemented Goods and Services Tax (GST) system is aimed to deliver a well-established IT-enabled system. A system that is capable of connecting with multiple administrative databases such as imports, exports, RBI, banks and income tax, just at the click of a button. In GST system, every penny in transaction is accounted from the source till the last stage of consumption.

The GST system holds that every supply of goods and services is to be taxed at the source of origination and at every stage of further supply. It will enable every registered reseller or user to claim full credit of taxes paid on earlier stages, provided the same is used for further sale or used in manufacturing of goods or provision of service.

In GST, the dual monitoring involving the Centre and the states will also curb income tax evasions. So, just in case, any set of tax authorities overlook evasion, there is the possibility that the other authority would readily detect it.

Under GST, usage of PAN and Aadhar will be more frequent.

It will be required to file GST returns. This will assist the income tax department to track transactions. There can be intense data mapping for audit by the revenue authorities.

E-filings would bring an end to back dating of any document furnishing incomplete details. This will also curb changing documents or information at a later stage, bypassing the prescribed procedure under law. With limited avenues to circumvent laws, there would be meager chances to engage in corrupt practices.

Real estate sector generates maximum amount of black money.

The uniform tax structure will improve tax compliance by local builders, investors, property dealers and occupiers. The Mandatory paper trail created under GST will improve tax compliance to a great extent.

GST strikes at the root of transactions where black money gets generated. Under GST, it is mandatory to get

How will GST benefit consumer?

Registered where threshold limit of -10 lacs is crossed. The system automatically generates purchase register for the buyer and allows tax credit to the purchaser, only after the seller uploads details of the organisation?s sales to another buyer who is registered. This linking continues to the consumer who is the last link in the supply chain. If a vendor fails to upload his/her sales, the buyer would lose the tax credit. Hence, the system dissuades the buyer to buy from a vendor who does not declare his/her sales. GST drives the tax evader out of business.

In this way GST is not just a fiscal reform. It is the beginning of a new era. The era where corruption will gradually subside and the common man will retain his right for equality and justice. GST would create a self-policing system with uniformity in the tax system across different states which would eliminate instances of tax arbitrage.

Contrary to the present tax system, GST's objective of simplifying the procedure and bringing in transparency to the tax structure will curb every scope of black money and corruption in India.

|

Present tax collection system. Example |

GST Collection system. ; Example |

|

Stage 1: In the process of creating jeans, the manufacturer buys raw materials for Rs.100 & adds value to the materials he stated out with. Let us take this value or/margin/profit added by him to be Rs.30. The gross value of his good would- be Rs.130 (100 + 30). At a tax rate of 10%, the tax on output will be Rs.13. Here good sold to wholesaler for Rs.143 (130+13).

Stage 2: The wholesaler purchases it for Rs.143, and adds on value (his ?margin?) of, say, Rs.20. The gross value of jeans he sells would then be Rs.163 (Rs.143+20) A 10% tax on this amount will be Rs.16.3. He will sell it to retailer for Rs.179.30. (163 + 16.3).

Stage 3: To retailer purchase price of Rs.179.30, he adds margin, of Rs.10. The gross value of jeans goes up to Rs.189.30 (Rs.179.3 + 10). The tax on this, at 10%, will be Rs.18.93. He will sell it to consumer for Rs.208.23 (189.3 + 18.93). |

Stage 1: Under GST, Manufacturer can set off this tax (Rs.13) against the tax he has already paid on raw material/inputs (Rs.10). Therefore, the effective GST on me manufacturer will be only Rs.3 (13 - 10). He will sell good to wholesaler for Rs.133 (100 + 30 + 3).

Stage 2: Wholesaler adds margin of Rs.20 on good. Its value = Rs.153 (133 + 20) Under GST, he can set off the tax on his output (Rs.15.30) against the tax on his purchased good from the manufacturer (Rs.13). Thus. The effective GST incidence on the wholesaler is only Rs.2.30 (15.30 - 13). He will set it to retailer for Rs.155.30(153 + 2.30)

Stage 3: Retailer adds margin of Rs.10 on good. Its value = Rs.165.3 (155.3 + 10) Tax 10% = 16.53 But by setting off this tax (Rs.16.53) against the tax on his purchase from the wholesaler (Rs.15.30), the retailer brings down the effective GST incidence on himself to Rs.1.23 (16.53 -15.30). Here good total value = 165.30 + 1.23 = 166.53. i.e consumer buys it for Rs.166.53. So, the total GST on the entire value chain from the raw material/input suppliers through the manufacturer, wholesaler and retailer is, Rs.10 + 3 +2.30 + 1.23,or Rs.16.53. |

Result: In current Tax system Consumer buys good for Rs.208.23 while in GST for Rs.166.53 Only.

Thus, Consumer saves Rs.41.70 (208.23-166.53)

Finance Commission

Under Article 280 of the Constitution, the President appoints a Finance Commission every five years to determine:

· the distribution of net proceeds of taxes to be shared between Centre and states;

· the principles which should govern the payment by Union of grants-in-aid to states; and

· Any other matter concerning financial relations between Centre and states.

Finance Commission is a constitutional body. However, its recommendations, called awards, are only advisory in nature and not binding on Central and State governments.

After the 73rd and 74th amendments, Finance Commissions are required to recommend steps to supplement resources of local bodies also.

The latest Finance Commission was set up on January 2, 2013, under the chairmanship of Dr. Y. V. Reddy, former RBI Governor. This is the 14th Finance Commission. Other members include Prof. Abhijit Sen, Ms. Sushma Nath, Dr. M. Govinda Rao Dr. Sudipto Mundle. The recommendations of the Commission Will apply on the period 2015-20

Finance Commission Appointed So Far:

|

Finance Commission |

Chairman |

Operational Duration |

|

First |

K.C. Neogy |

1952-57 |

|

Second |

K. Santhanam |

1957-62 |

|

Third |

A.K. Chanda |

1962-66 |

|

Fourth |

P.V. Rajamannar |

1966-69 |

|

Fifth |

Mahavir Tyagi |

1969-74 |

|

Sixth |

K. Brahmananda Reddy |

1974-79 |

|

Seventh |

J.M. Shelat |

1979-84 |

|

Eighth |

Y.B. Chavan |

1984-89 |

|

Ninth |

N.K.P. Salve |

1989-95 |

|

Tenth |

Late Shri KV Pant |

1995-2000 |

|

Eleventh |

A.M.Khusro |

2000-2005 |

|

Twelfth |

C. Rangarajan |

2005-2010 |

|

Thirteenth |

Dr. Vijay L Kelkar |

2010-2015 |

|

Fourteenth |

Yega Venugopal Reddy |

2015-2020 |

Monetary Policy

Monetary policy refers to the set of measures adopted by the Central bank, i.e. Reserve Bank of India (RBI) for monetary management.

Monetary Policy Objectives

· Stability of external value: Fluctuation in exchange rate of a currency affects foreign trade and investment. It is, therefore, important that the rate of exchange is maintained without violent fluctuations.

· Maintenance of domestic price level: Fluctuation in prices affects investment decisions. It also leads to increasing income disparities. However, monetary policy alone cannot ensure the maintenance of domestic prices, as several other factors such as erratic monsoons, changes in tastes, fluctuation in world prices, etc. affect domestic prices.

· Reducing the impact of business cycles (slumps and booms) by manipulation of credit and interest policy.

However, economists are not of the same opinion on whether business cycles are primarily caused by monetary factors.

Indian Monetary Policy

Planned economic development adopted by India required an active monetary policy. The two stated aims of this policy were:

· Boost economic development.

· Control inflationary pressure.

The Reserve Bank of India is the nodal agency for implementing the monetary policy. RBI has defined its monetary policy in terms of ?adequate financing of economic growth and at the .same time ensuring reasonable price stability?. The agreement on Monetary Policy framework between the Government and the RBI dated February 20, 2015 defines the price stability objective explicitly in terms of the target for inflation- as measured by the consumer price index- combined

(CPI-C) in near to medium term, i.e.

(a) Below 6% by January 2016, and

(b) 4% for the financial year 2016-17 and all subsequent years.

The government amended the Reserve Bank of India Act 1934 in 2016. The amendment Act provides for a statutary basis for the constitution of an empowered Monetary Policy Committee.

The Amendment Act also provides for inflation target to be set by the Government in consultation with the Reserve Bank once in every five years. As per the revised monetary policy framework, the government has fixed the inflation target of 4% with tolerance level of +/-2% for the period beginning from 5th August, 2016 to 31st March, 2021.

Monetary Policy Committee

The Government notified the constitution of the MPC on

25th September, 2016. It has six members. Three of them are Government nominees. The other three include the RBI Governor, Deputy Governor of RBI in charge of monetary policy and Executive Director of the RBI. The MPC is headed by the RBI Governor. The government nominees will have a four-year term. At present the members of MPC are Urijit Patel, R. Gandhi (Dy Governor, RBI), Michael Patra (Executive Director, RBI), and three government nominees- Chetan Ghate, Pami Dua, Ravindra H Dholakia.

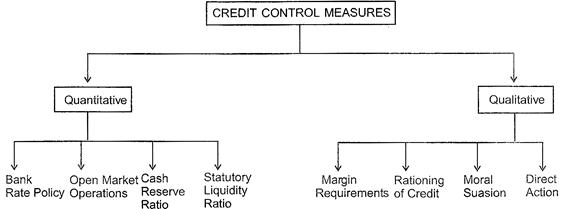

RBI instruments it is to achieve a stable monetary policy which includes:

Bank Rate

It is the rate at which RBI rediscounts the bills of exchange. In practice, it is the rate at which RBI lends to other commercial banks. It thus acts as a signal to the economy on the direction of the monetary policy. Bank rate had a limited impact in the period before economic reforms (1991) when RBI would determine the interest rate structure. However, with the delegating of this power to the commercial banks (except interest rates in priority sectors) the importance of bank rate has been revived. RBI uses changes in Bank Rate to regulate fluctuations in exchange rate and domestic inflation,

When bank rate is raised, it is called "dear money policy" which implies that commercial banks would also raise the rate of interest at which they would lend to various sectors in the economy. On the other hand, when bank rate is lowered, it is called clieap money policy'. Generally, bank rate may be raised during period of inflation, and may be lowered during a period of slowdown and recession.

Cash Reserve Ratio (CRR)

Every commercial bank is required to keep a certain percentage of its demand and time liabilities (deposits) with the RBI (either as cash or book balance). The RBI varies this ratio to change the liquidity of market. When this ratio is raised, it is called a policy of ?credit squeeze? and when lowered, it is known as a policy of ?credit liberalization? it may generally be raised during inflation and lowered during a slowdown. RBI is empowered to fix the CRR at a rate ranging between 3% per cent and 15%. Like the Bank Rate, CRR is also subject to frequent changes as RBI intervenes from time to time to correct monetary or exchange rate imbalances.

Statutory Liquidity Ratio (SLR)

Statutory liquidity ratio refers to the amount that the commercial banks require to maintain in the form of cash, or gold or government approved securities before providing credit to the customers. Here by approved securities we mean bond and shares of different companies. Statutory liquid ratio is determined and maintained by RBI in order to control the expansion of bank credit. It is determined as percentage total demand and percentage of time liabilities. Time liabilities refer to liabilities, which me commercial banks are liable to pay to the customers on demand or pay within one month's time, due to completion of maturity period. The maximum limit of SLR is 40%.

If any Indian bank fails to maintain the required level of SLR, then it becomes liable to pay penalty to RBI. The defaulter bank pays penal interest at the rate of 3 % per annum above the bank rate on the shortfall amount for that particular day. If the defaulter bank continues to default on the next working day then the rate of penal interest can be increased to 5% per annum above the bank rate. This restriction is imposed by RBI on banks to make funds available to customers on demand as soon as possible. Gold and Government securities (Gilts) are included along with cash because they are highly liquid and safe assets.

RBI can increase the SLR to contain inflation, suck liquidity from the market, and to safeguard the customers' money.

Open Market Operations

This refers to the RBI buying and selling eligible securities to regulate money supply. Traditionally RBI was not resorting to this method. However, after the large inflow of foreign funds since 1991, RBI has had to step in to sterilize the flow to avoid excess liquidity.

Repo and Reverse Repo

Repo (Repurchase Option) and Reverse Repo are instruments used by RBI in day-to-day liquidity management. Repo rate is the rate at which RBI lends to commercial banks and Reverse Repo is the rate at which RBI borrows from commercial banks. In inflationary situations, RBI can hike [he Reverse Repo rate and absorb the excess liquidity in the market. Similarly, in case there is a requirement to increase liquidity into the system, RBI can reduce the Repo rate which will lead to release of money into the market. RBI occasionally resorts to the Repo rate to fine-tune the liquidity position, without resorting to major policy instruments such as changes in CRR and Bank Rate. However, markets are bound to react to frequent changes in the Repo rates and this will be reflected to frequent in corresponding changes in the deposit and lending rates of commercial banks.

Margin Requirement- refers to difference between the securities offered and amount borrowed by the banks.

Rationing of Credit - RBI controls the credit granted/ allocaied by commercial banks.

Moral suasion - Psychological means and infonijal means of selective credit control.

Direct Action - Refers to the step taken by the RBI against banks don?t fulfil conditions and requirements.

Capital Account Convertibility (CAC)

A currency is said to be convertible when it can be freely exchanged for another currency at market rates. Transaction of current account includes dealing with payments relating to foreign trade, travel and other services. Capital account deals with transaction in financial assets. While India has made the Indian rupee fully convertible on current account, it is yet to accept capital account convertibility as a goal. Broadly, capital account convertibility would mean freedom for firms and residents to freely buy into overseas assets such as equity, bonds, property, and acquire ownership of overseas firms besides free repatriation of proceeds by foreign investors.

India is reluctant to increase the pace of Capital account convertibility by taking experience of Mexico. It was one of the largest recipients of foreign private capital ($29 billion in 1993). But, with the devaluation of its currency and the collapse of the exchange rate, much of the capital fled the country. This catastrophic collapse was due to capital account convertibility, which encouraged even Mexican residents to convert their capital into dollars, precipitating the crisis. Similar situation arose in the late 1997 in South East Asian countries also where their local currencies were devaluated by 58% in one month.

There is a difference in concept between 'Full Currency

Convertibility' and a 'Fully Open Capital Account'. Currency convertibility refers to the absence of any restriction on the holding of foreign currencies by residents and of the national currency by foreigners, and on free conversion between currencies. It does not preclude restrictions on the type and quantity of non-currency assets that residents can hold abroad or foreigners can hold in the country. An Open Capital Account, on the other hand, is the absence of restrictions on non-currency asset holdings, and can exist without free conversion of the currency.

While India made the rupee fully convertible under current account, it was felt that the economy was not yet ready for capital account convertibility. The countries which went in for hasty CAC in the 1980s had to face financial crisis. The thinking was that trade and domestic liberalization process should be completed before CAC can be thought of. Many economists feel that CAC will only help the drain of Indian capital, which will get invested abroad. The present policy is to go slow on CAC.

The RBI appointed the Committee on Capital Account Convertibility (CAC) with S.S Tara pore as chairman.

The Committee submitted its report in 1997 setting a three-phase time-table (1997-98, 1998-99, 1999-2000) to achieve CAC. The Committee, recommended that capital account convertibility would be greatly beneficial for India by making available large funds (which would promote economic growth) and improved access to world financial markets, bringing about an improvement of the country's financial system in the global context, besides allowing Indians to acquire and hold international securities and assets.

Before attaining full convertibility, the CAC recommended, India was to fulfil certain important preconditions:

Fiscal consolidation: Reduction in gross fiscal deficit from 4.5% of GDP in 1997-98 to 3, 2% in 2017-2018.

Mandated inflation rate: The mandated rate of inflation for 3 years should be an average of 3 to 5 %.

Based on the recommendations of the Committee, the Foreign Exchange Regulation Act (FERA) was repealed and replaced with Foreign Exchange Management Act (FEMA) in June 2000.

FERA was considered a very rigid regulation and promoted conservation of foreign exchange. FEMA in turn encouraged the formation of a foreign exchange market and facilitated trade.

You need to login to perform this action.

You will be redirected in

3 sec