Category : Banking

Latest Development in IT Related to Banking

With the globalization trends world over it is difficult for any nation big or small, developed or developing, to remain isolated from what is happening around. For a country like India, which "s one of the most promising emerging markets, such isolation is nearly impossible. More particularly in the area of Information technology, where India has definitely an edge over its competitors, remaining away or uniformity of the world trends is untenable. Financial sector in general and banking industry in particular is the largest spender and beneficiary from information technology. This endeavours to relate the international trends in it with the Indian banking industry. The last lot includes possibly all foreign banks and newly established Private sector banks, which have fully computerized all the operations. With these variations in the level of information technology in Indian banks, it is useful to take account of the trends in Information technology internationally as also to see the comparative position with Indian banks. The present article starts with the banks perception when they get into IT up gradation. All the trends in IT sector are then discussed to see their relevance to the status of Indian banks.

The government and the regulator have undertaken several measures to strengthen the Indian banking sector.

DEVELOPMENT BY INDIAN GOVERNMENT IN IT FIELD

Government Working on New National E-Mail Service

Dot Bharat domain lauched by Govt

Union Government launched a new domain Dot Bharat in Devanagari script. Originally the domain will cover 8 languages like Hindi, Bodo, Dogri, Konkani, Maithili, Marathi, Nepali and Sindhi.

These 8 languages are from the list of 22 languages that has been contained in the Schedule-8 of the Constitution of India.

Objective

To connect individuals with social media and deliver content in regional languages, particularly to those who are not acquainted with English.

To deliver information to persons in their own regional languages which will help in advancement of e-governance.

The domain was developed by the joint efforts of National Internet Exchange of India and CDAC (Centre for Development of Advanced Computing). Dot Bharat (.Hkkjr) would substitute the normally used top domains like .corn, .in, .net, etc.

‘Digital Cloud’ for every Indian

PM Narendra Modi’s next giant drive to free up service delivery from the hold of the lower bureaucracy will be in the form of a ‘digital cloud’ for every Indian.

Now, Certificates issued by the Govt.: Education, residential, medical records, birth certificates, etc. will be saved in separate ‘digital lockers’ and a communication protocol will be established for Govt Departments to access them without actually having to see the hard copy.

The idea is very clear, it is not desired that copies of certificates issued by the government itself to be carried everywhere by people to government offices for several services, e.g. if a student is applying for a government college and has studied in a government-aided school, his birth certificate, identity details and educational certificates, school-leaving details, et al should be available to Govt. institutes where he is applying. Likewise his medical records, etc.

Ministry of Railways Launches New Improved e-Ticketing System

Now booking rail tickets through the IRCTC website will be faster and smoother than before with the new e-ticketing system developed by Centre for Railway Information Systems (CRTS). IRCTC has developed and introduced following e-systems:-

Reserve Bank issue draft guidelines for 'anytime anywhere' Bharat Bill Payment System

To introduce an 'anytime anywhere payment system', the Reserve Bank of India (RBI) issued draft guidelines for the implementation of Bharat Bill Payment System (BBPS). The draft mentions the requirements and the basic framework of operating the BBPS, and stipulates the eligibility criteria, standards for settlement model and customer grievance redressal, roles and responsibilities and scope for entities seeking to be part of BBPS. RBI's plan to implement an 'anytime anywhere' centralized payment system is based on a report submitted by the GIRO (Government Internal Revenue Order) Advisory Group. GIRO Advisory Group (GAG) was constituted by the RBI in October 2014, under the chairmanship of Prof. Umesh

Bellur, Indian Institute of Technology, Bombay to implement a national GIRO-based Indian Bill Payment System.

The panel had recommended a mechanism for centralized bills payment system in India, mainly by laying out 2 organizations:

(1) Bharat Bill Payment Services (BBPS) . ,

(2) Bharat Bill Payment Operating Units (BBPOUs)

India set to build supercomputer grid

Determined to raise India's ranking in the world of high-performance computers, the government is set to clear a Rs. 4,500-crore ($730 million) mission to build supercomputers nearly 40 times quicker than our fastest one. The mission intends to set up 73 supercomputing facilities on a buy-and-build approach at academic and research institutions across the country and network them into a grid. Three of them — the first ones to be set up over the first three years — would be India's first supercomputers capable of peta-scale computing and would join a global league of just 37 such machines.

The seven-year plan has been divided into two phases — the first three years for construction of the machines and the next four for the applications that will use this grid. The supercomputers will occupy a space of over 20,000 square feet, or the size of 10 three-bedroom apartments.

At present, India has two supercomputing machines in the world's top 100, and nine in the top 500. Its fastest supercomputer at the Pune-based Indian Institute of Tropical Meteorology is ranked 52. A little less than half of all supercomputers in the top 500 — 233 — are in the US. But the world's fastest, Tianhe-2 (MilkyWay-2), belongs to China's National University of Defense Technology. A late entrant, China has 75 other supercomputers on the list — nearly as many as Japan (30), France (27) and Germany (23) put together.

IMPORTANT BANKING SCHEMES & APPs

3D PRINTING IN BANKING

3D printing will disrupt the traditional economics of global industry, which means it will disrupt banking. How far it goes depends on how successful 3D printing is - and how quickly - but to finish off, here's a final thought.

3D printing means faster product development, lower costs in the prototyping phase, an increase in the amount of products that can be developed and also more niche products.

The price of 3D printable materials will rise, making the raw commodities prices change. Oil will become less important as a fuel and more valuable where it's used in plastics. Recycled materials and recycling processes will become more valuable (they are a source of 3D print materials) which will upset mining and ore prices, may be even staples like steel, silver and gold.

How will 3D printers help improve banking KYC?

3D printers are widely known to offer the potential to be a game changer in the physical supply chain across many sectors and industries. However, the opportunity in Financial Services seems less likely, particularly in any form of real, practical application. Do you agree, or not with my statement here? Well, either way, suggest you read on to find out more.

Unified Payments Interface (UPI)

“Unified Payment Interface” (UPI) enables all bank account holders to send and receive money from their smart-phones without the need to enter bank account information or net banking user-id/ password.

It is a system that powers multiple bank accounts (of participating banks), several banking services features like fund transfer (P2P), and merchant payments in a single mobile application.

UPI was launched by National Payments Corporation of India with Reserve Bank of India's (RBI) vision of migrating towards a 'less-cash' and more digital society. UPI has built on the Immediate Payment Service (IMPS) platform.

UPI platform can be used for:

How UPI app works

Any Android smart-phone user who has an account with a UPI-partnered bank can download a UPI app such as iMobile (for ICICI Bank customer) and Pockets (for ICICI/ non-ICICI Bank customers) and create their own Virtual Payment Address (VPA) such as xyz@pockets or xyz@icici to start using UPI.

Bhim APP

BHIM is a digital paymants soluation app based on Unified Payments Interface (UPI) from the National Payments Corporation of India (NPCI). If you have signed up for UPI based payments on your respective bank accounts, which is also linked to your mobile number, then you will be able to use the BHIM app to conduct digital transection.

Payment bank

Payments banks are a new model of banks conceptualized by the Reserve Bank of India (RBI). These banks can accept a restricted deposit which is currently limited to INR 1 lakh per customer and may be increased further. These banks cannot issue loans and credit cards. Both current account and savings accounts can be operated by such banks. Payments banks can issue services like ATM cards, debit cards, online banking and mobile banking. Airtel has launched India's first live payments bank. Paytm is the second such service to be launched in the country. India Post Payments Bank is the third entity to receive payments bank permit after Bharti Airtel and Paytm.

Airtel money

Airtel has started a new m-commerce platform called Airtel Money in collaboration with Infosys and Smart Trust (now Giesecke & Devrient). The platform was launched on 5 April 2012, at Infosys' headquarters in Bangalore. Using Airtel Money, users can transfer money, pay bills and perform other financial transactions directly on the mobile phone. It has an all-India presence, certain charges are levied per Airtel Money transaction.

Branch on Wheel - ICICI Bank in Odisha

India's ICICI adds 'Branch on Wheels' Sept. 9, 2013. ICICI Bank Ltd. has launched its "Branch on Wheels" as part of a financial inclusion plan that aims to provide banking services to unbanked villages in India. The initiative is the first of its kind to be implemented by one of the country's private sector banks.

Digital Banking "POCKET' - ICICI

India's largest private sector lender, ICICI Bank, has launched an e-wallet called 'Pockets', which can do everything payments banks can do. Pockets' is a mobile application, which can be used to send money, pay utility bills, book movie tickets, send gifts and share expenses. One can use this service even if one doesn't have an ICICI Bank account. With this app, one can also open a zero-balance account.

Chillr-HDFC Bank

Chillr is launching first for HDFC Bank and is available exclusively for customers of HDFC Bank. As an HDFC Bank customer, you ca also transfer money to your contacts having other bank accounts. Chillr is a revolutionary new app that lets you send money immediately to anyone in your phone book, 24 hours a day, 7 days a week.

We-Bank

It is a Chinese first online banking system. Chinese Internet giant Tencent Holdings Ltd made first online banking affiliate We-Bank is close to raising fresh funds from investors including U.S. private-equity firm Warburg Pincus in a deal that values the year-old venture at more than 5 billion, people familiar with the matter said.

We-Bank, which is 30%, owned by Tencent, is raising more than 450 million in the round led by Warburg Pincus as well as Singapore's state-owned investment firm Temasek Holdings Pte. Ltd., the people said. The online bank's first fundraising round since its operations began a year ago puts a roughly 5.5 billion price tag on the company including the fresh funds, the people said.

Kay-Pay

Kotak Mahindra has launched world's first Face-book based instant funds transfer platform: Kay-Pay. The beauty of this online based Social banking platform is its simplicity: now anyone can transfer funds between their Face-book friends without using internet.

SBI eforex

State Bank of India said it has launched SBI eforex -SBI launched an initiative to provide doorstep services and expedite home loans application process -State Bank of India jointly launched a cyber-crime awareness campaign.

E-KYC - SBI

State Bank Group has developed the e-KYC application which will read the customer's Aadhaar Number and Fingerprints for e-KYC verification. This will be sent to UIDAI and on successful verification from UIDAI, this application will display, print and issue an e-KYC certificate which can be used by the BC to open an account subject to satisfying other account opening requirements.

All VLEs are advised to make best use of it for customer account opening keeping in view the Prime Minister Dhan Jan Yojana. VLEs should open maximum number of accounts given the ease involved in account opening. SBI has started the implementation of e-KYC for account opening.

I-Mobile app for windows phone - ICICI:

I-Mobile is ICICI Bank's official mobile banking application. I-Mobile, the most comprehensive and secure Mobile Banking application, getting payments done through Unified Payment Interface (UPI), offers over 100 banking services on your windows mobile.

India's first" transparent credit card "in association with American Express - ICICI:

ICICI Bank on 12 dec 2014 launched India's first credit card with a unique transparent design and a distinctive look. The credit card named ICICI Bank coral American express credit card. The card is a part of gemstone collection of ICICI Bank in association with American express.

M-Pesa

It is a mobile phone-based money transfer, financing and micro-financing service, launched in 2007 by Vodafone for Safari-corn and Vodacom, the largest mobile network operators in Kenya and Tanzania M-Pesa customers can deposit and withdraw money from a network of agents that includes airtime resellers and retail outlets acting as banking agents. The service enables its users to:

M-Wallet

It is a very young concept in India that has taken on consumer psyche rapidly. Everyone is loving mobile wallets and embracing them with open arms today, mobile wallet is one of the successful business ideas for start-ups. The evidence lies in the fact that it has surpassed credit cards in terms of the number of users in just a fraction of time.

TAB BANKING FACILITY

SBI has launched the facility of TAB banking for customers opening of Savings Bank accounts and another for Housing Loan applicants. SBI will offer its valued customers the facility of opening accounts at their door step through Tab.

Tap and pay - ICICI

ICICI Bank has launched Proximity Payment Solution, a simple Tap and Pay experience using NFC (Near Field Communication) enabled tag. The solution has several benefits:

Go cashless and card-less with mobile payment technology Ultra-cash:

Merchant payments in India are still considered a cash-driven space. However, one can start reverse counting to see the world going cashless and card-less with the next generation of mobile payments. What if you discover that you forgot to carry your wallet after reaching a retail store? The Ultra cash app aims to help users in such a situation to shop seamlessly.

Three types of cashless transaction options via prepaid payment instruments for you:

With limited cash in hand and an indefinite crunch in sight, most people are rushing to cashless transactions. "Digital transactions bring in better transparency, scalability and accountability. The RBI classifies every mode of cashless fund transfer or transaction using cards or mobile phones as ‘prepaid payment instrument’.

These can be issued as smart cards, magnetic stripe cards, Net accounts, Net wallets, mobile accounts, mobile wallets or paper vouchers. These are classified into three types:

Closed: Issued by an entity for purchasing goods and services only from it these don't allow cash withdrawal or redemption. Ola Money is one such closed wallet.

Semi-closed: These are used to buy goods and services, including financial services, from merchant that have a specific contract with the issuer. These too don't allow cash withdrawal or redemption and include wallets offered by service providers like Paytm and State Bank Buddy.

Open: These can be used to buy goods and services, including fund transfers at merchant locations, and also permit cash withdrawals at ATMs. All Visa and Master-Card cards fall into this category.

CASHLESS MODES

Mobile wallet: This is basically a virtual wallet available on your mobile phone. You can store cash on the mobile to make online or offline payments. Various service providers offer these wallets via mobile apps, which you need to download on the phone. You can transfer the money into these wallets online using credit/debit card or Net banking. This means that every time you pay a bill or buy online via the wallet, you won't have to furnish your card details. You can use these to pay fees, bills and make online purchases.

Net banking: This does not involve any wallet and is simply a method of online transfer of funds from your bank account to another bank account, credit card, or a third party. You can do it through a computer or mobile phone. Log in to your bank account on the Net and transfer money via national electronic funds transfer (NEFT), real-time gross settlement (RTGS) or immediate payment service (IMPS), all of which come at a nominal cost ranging from Rs (5 to 55).

Plastic money: This includes credit, debit and prepaid cards. The latter can be issued by banks or non-banks and can be physical or virtual. These can be bought and recharged online via Net banking and can be used to make online or point-of-sale purchases, even given as gift cards.

Plastic Bank: it has a mission statement to create and lead a movement for 'Social Plastic' towards worldwide demand for the use of Social Plastic in everyday products. The higher the worldwide demand becomes, the higher the reward will be for harvesting Social Plastic. This is achieved through 'Plastic Banks' established strategically in impoverished areas with an existing abundance of plastic waste. The Plastic Bank will offer people both education and the opportunity to trade re-usable plastics for credits that can be used for the printing of 3D products, re-purposed necessities and/or micro-finance loans.

LATEST DEVELOPMENT IN TI FIELD:

Electronic Digital Paper

Electronic paper utilizes new display technology called gyricon this gyricon sheet is thin layer of transparent plastic sheet. It developed at Xerox Palo Alto Research Center (PARC), electronic paper is new kind of display somewhere between paper and conventional computer screen like paper, it is thin, lightweight, and flexible like computer display, it is dynamic & rewritable wide range of potential applications, including:

Plastic Displays

Researchers have recently made break throughs in developing displays out of poly-ethylene tere phthalate (PET) it is a thin, flexible, rugged plastic that you can bend, roll up, fold, or form into practically any shape.

Applications could include notebook and desktop displays, hand-held appliances, it also, wearable. Displays sew into clothing, and paper thin electronic books and newspapers

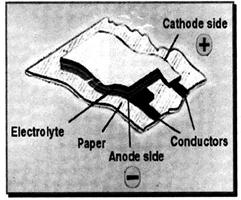

Power Paper

Computers and other electronic devices becoming thinner and thinner, laptop computer could be as thin as a sheet of paper power supplies must slim down as well power paper, an Israel-based company, has developed paper-thin battery technology.

Power electronic devices, games, greeting cards, smart cards, luggage tags, medical devices Imagine smart tickets to sporting events to avoid counterfeiting and give directions to seat could be very useful in computerized clothing and wearable computers

Power Paper cell will be one-half millimeter thick, and will generate 1.5 volts.

Printable Computers

In printable computer researchers developing ink-based, plastic processor & printable computer components not designed to replace silicon (about 100 times slower) plastic offers some benefits over silicon & silicon is rigid, while plastic chips are flexible & it will lead to simple computers to give intelligence to everyday objects could be integrated into clothes, food labels, simple appliances, toys

Wearable Computers

Applications like hearing aids with sound enhancement software & "Glasses" with multi-informational display about what is being seen, where you are Wrist computers, PDAs, cell phones. Next step is computerized clothing Including computers in standard clothing items like shoes, pants, shirts, jackets, belts even underwear Some of these devices already making their way into consumer market.

Working to integrate computers and related devices directly into clothing, so that they are virtually invisible interaction via sensors, all fabric keypads, speakers, voice recognition receivers, thin light-emitting diode (LED) monitors, flat screen (plastic) displays, holographic projectors another step in making computers and devices portable without having to carry and manipulate plethora of gadgets.

Other development in IT field

Vehicles - cars, bicycles, lawn mowers, snow blowers, chain saws, etc.

Appliances - Home security, heating/air conditioning, refrigerator, oven, dishwasher, lighting system, entertainment systems, washer, dryer, garage door opener, "watering" systems etc.

You need to login to perform this action.

You will be redirected in

3 sec